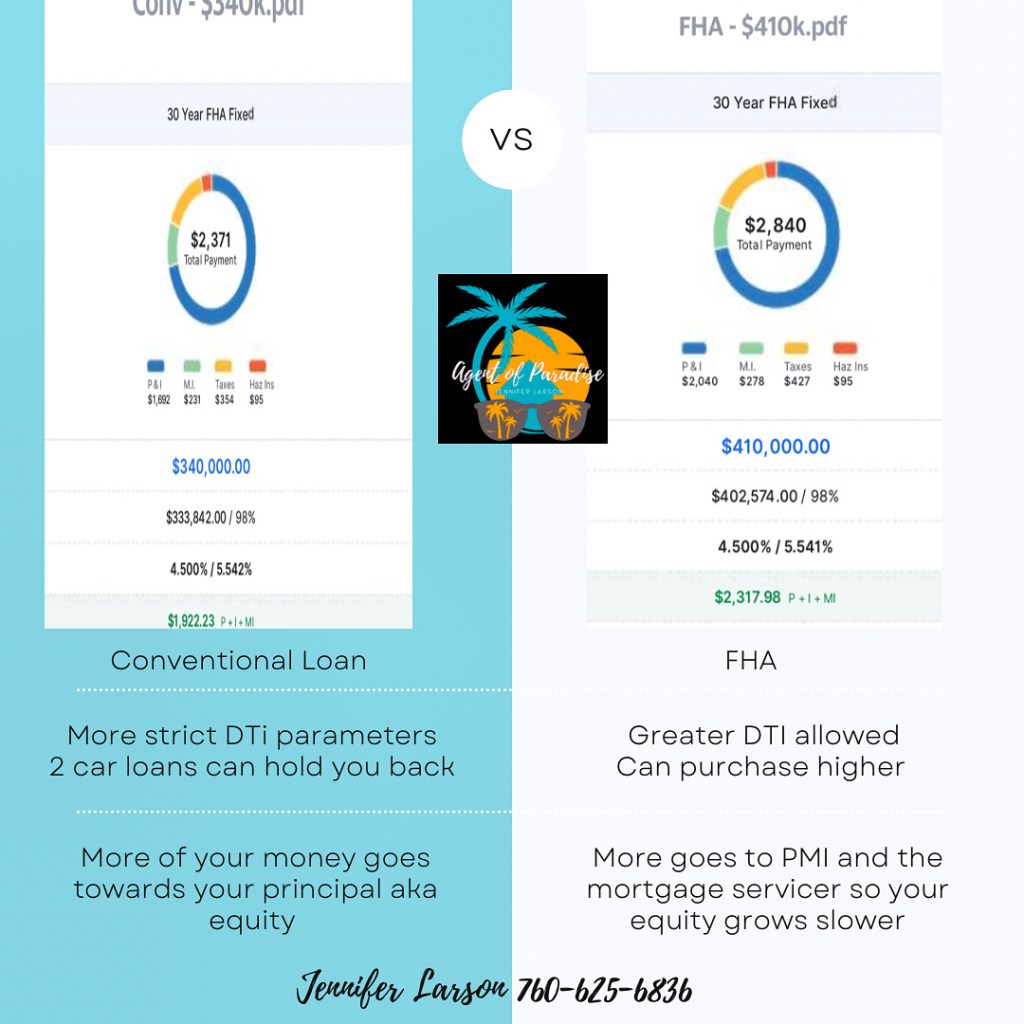

Same client, same day. Why are the loan amounts so different and what are the different loans?

As the graphic shows conventional loans require a smaller debt load in order to qualify and get a higher approval rate. They’re beneficial to properties not able to be purchased under FHA guidelines and they also help you build equity faster with more of your payment actually going to your total balance/purchase price.

FHA loans have property requirements and some homes like condos do not qualify for an FHA loan so you’d have to go conventional. If you can qualify for FHA, particularly if you require down payment assistance, then you will pay more for services and private mortgage insurance (sort of like collateral for the lender) but you can qualify for a more expensive home even with the exact same circumstances.

For instance, if you have two car payments that will greatly hinder your buying power with a conventional loan while FHA is more forgiving; allowing up to 45% DTI. With conventional you need to cap it at 30% and watch your credit card balances so they don’t rise over that.

Rates have dipped below 5% for buyers which is reminiscent of pre-pandemic levels. Home prices are dropping as well and sellers are providing incentive’s towards closing. Now is a time to buy!

Need a lender? I know a few. Text me at 760-625-6836 for a list of recommendations.