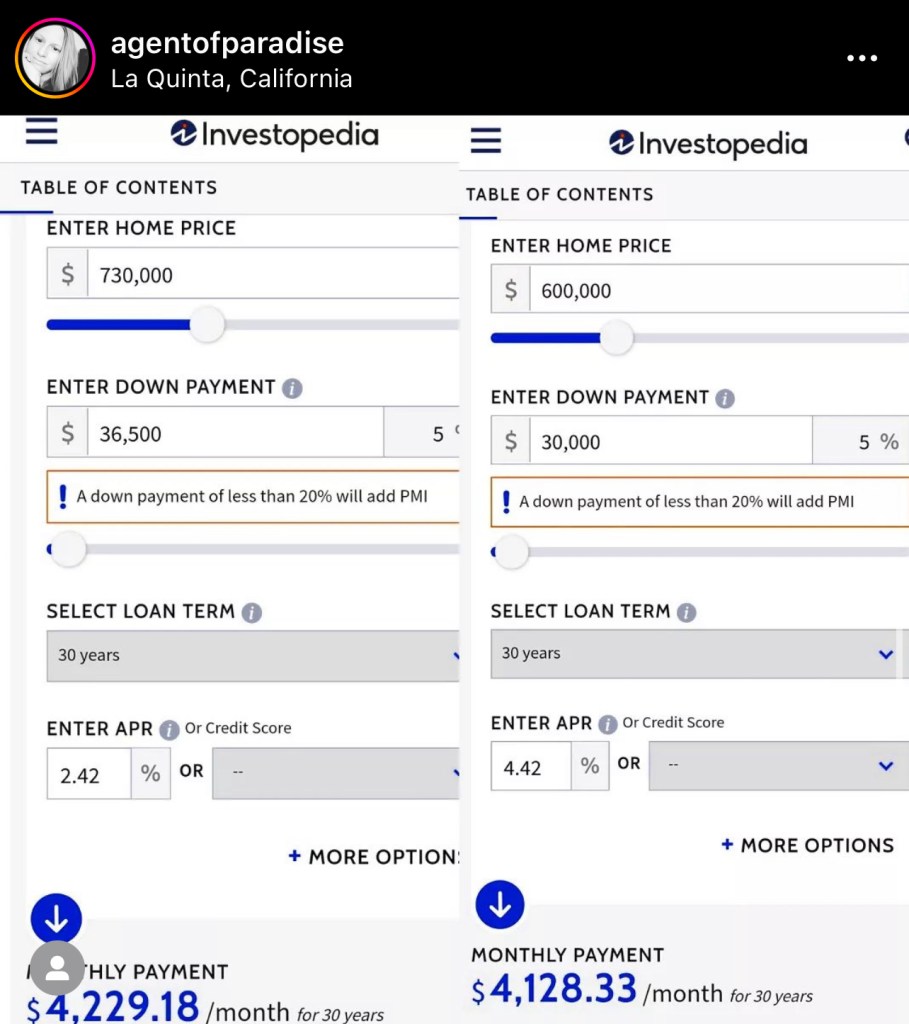

Waiting for the market to “drop” DOESN’T SAVE YOU MONEY! It only COSTS YOU what you can get for the same payment and what you can get your family. $101 monthly difference is keeping your from getting a way better home FOR THE SAME PRICE. Wake up and do the math!!!!

Your payment is about your interest rate. The home price has little to do with how much you pay every month. Stop looking at home prices and look at interest rates. That’s what actually makes up your payment and how much you pay overtime. The home price is just a barometer for lending metrics.

And this is based on a person with excellent credit. If you have less than 700, you’re paying EVEN MORE per month on the 600k, because you won’t qualify for more, if you even get approved for the 600k with that low of credit, because your interest will be even HIGHER.

Interest is the bulk of your payment. That’s what you should be most worried about.

If you have less than 700 credit scores and waited for the market, you are now paying MORE than the person with a 700 and lower interest despite “saving” 130k on the home.