Be sure to read the previous blog post as well for more information how rates, not home price, affect your buying power, budget, and monthly payment.

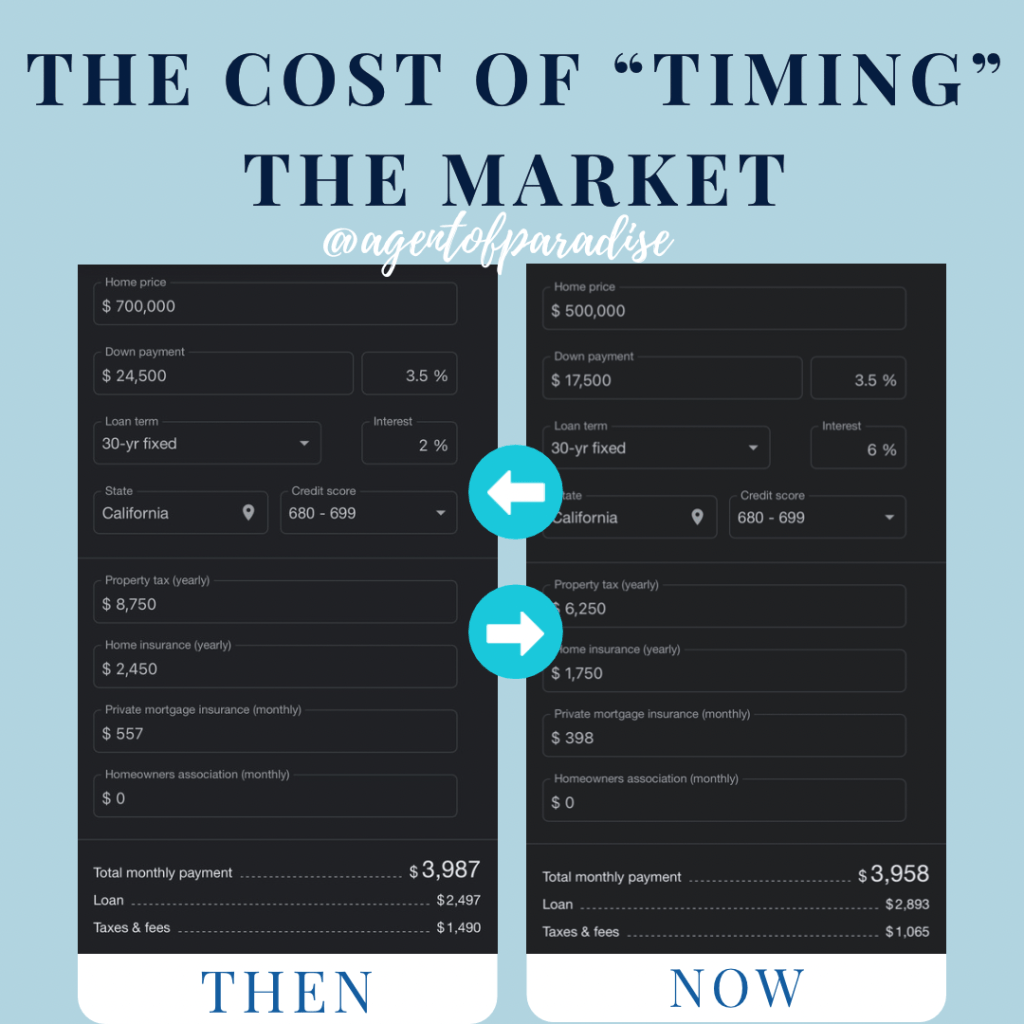

This idea of timing the market is more myth and urban legend than strategy or budget hack. The mad rush of the last two years was because of insanely low interest rates were allowing people to buy their dream homes for actually CHEAPER than they are now. Now for those same people, the homes they’re in would be out of reach today. Yep. The difference interest rates have is the only difference in these two examples. Same client and circumstances. What a difference two years makes. Waiting means now you can only buy a $500,000 house which nowadays isn’t much. Two years ago you could have bought a $700,000 home which was still better than todays 500k and paid the same amount! That’s why the market was nuts. 💰

Home price is nearly irrelevant unless you are flipping the home or selling soon afterwards. Otherwise, it’s Mortgage Rates that matter. That’s how lenders approve you. NOT by total amount. That’s just for you so you know how to search on @zillow ✌🏼

📞 💬 📧 Jennifer Larson for more information on connecting with a lender and buying or selling a home.