Here’s the truth:

- You SHOULD buy. The right time to buy is when the time is right for you financially and when you are sick of paying record high rents. Lower prices do NOT mean lower mortgage payments so timing prices is a waste of time. It’s not at all saving you money.

2. You CAN by multi-family properties, up to 4 units, with your FHA home loan. If you are interested in investing or “house hacking” to live free, then try purchasing a duplex, triplex, or 4-plex with an FHA mortgage first before exploring other financing options. Make sure to speak with your lender to discuss your goals at time of application and when you locate a property of interest.

3. It’s always a good time to sell. People are always buying and even 2008 didn’t change that. Whenever it’s best for you to sell and move on with your life, that’s when it’s best to sell. Thanks to the last two years of wild buying, equity is still very high and bidding wars are virtually gone. Selling now is even easier to move to your next home.

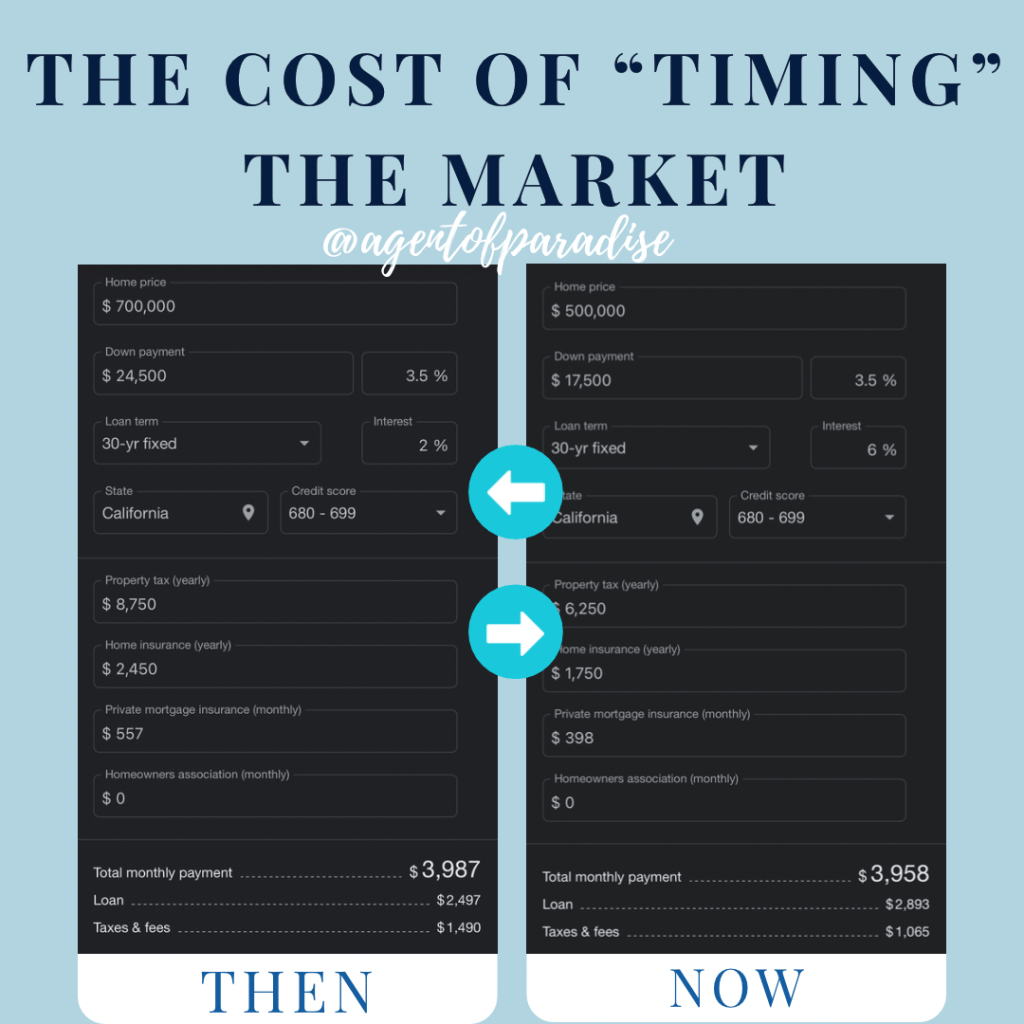

4. Prices may go down a little in some markets but overall hardly anything and they’re leveling out. Even a $20k drop isn’t going to save you hardly anything at all on your monthly mortgage payment. Prices make little impact actually. Payments are calculated on rate. Prices just value and secure the loan.

5. It’s certainly NOT cheaper to rent right now. Rent prices soared the last two years and unlike home prices, they’re not going to start dropping and become easier to obtain. Rents stay high even when they stop rising and waitlists are a growing problem across the country which allows property managers of apartments and homes to keep them that way. It’s cheaper to buy a 3/2 with an FHA loan and you can write off on your taxes if you talk to a tax professional to file them for you. It’s actually not expensive.

6. As always, mortgage payments are calculated by mortgage rates. The home value is a tool for buying purposes for the lender and seller actually. The buyer’s costs are the monthly payment which is decided by interest rates and then calculated as a total loan value for you to write offers. It’s not decided then broken down into a payment for you. That’s not how mortgages work.

Here’s an example of why interest rates are crucial to understand and how they drive your payment instead of price: