Most people are well aware of the common government loans such as FHA, VA, and USDA as well as conventional loans. Many people I work with don’t know there are an array of different loans that are qualified mortgages available to the masses by traditional lenders that are also sound options. How many of these have you heard of?

I will discuss ARMs in a coming soon post but here’s a basic overview of what they are and how they work:

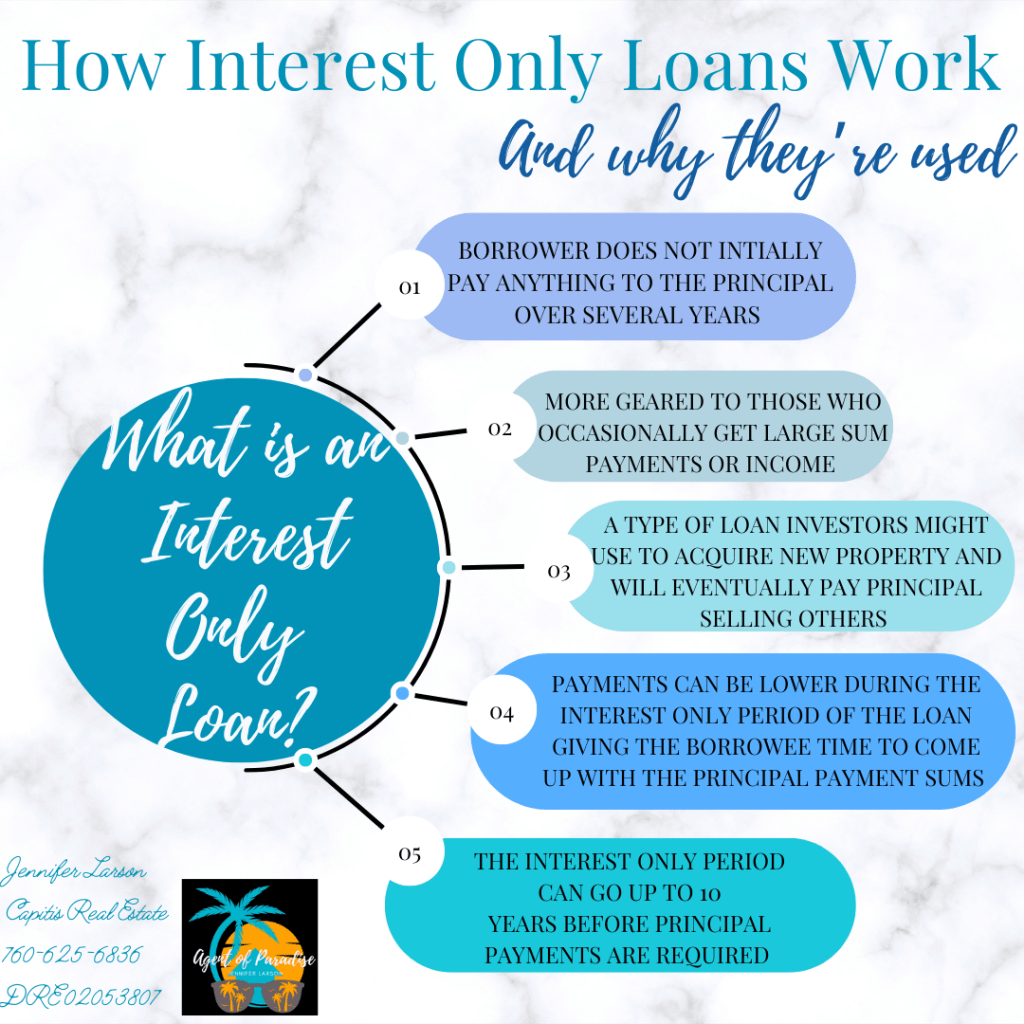

The next are Interest Only loans which are unlikely to be a best option for most but for a select few may be an ideal option such as military and those temporarily in their homes for only a couple of years.

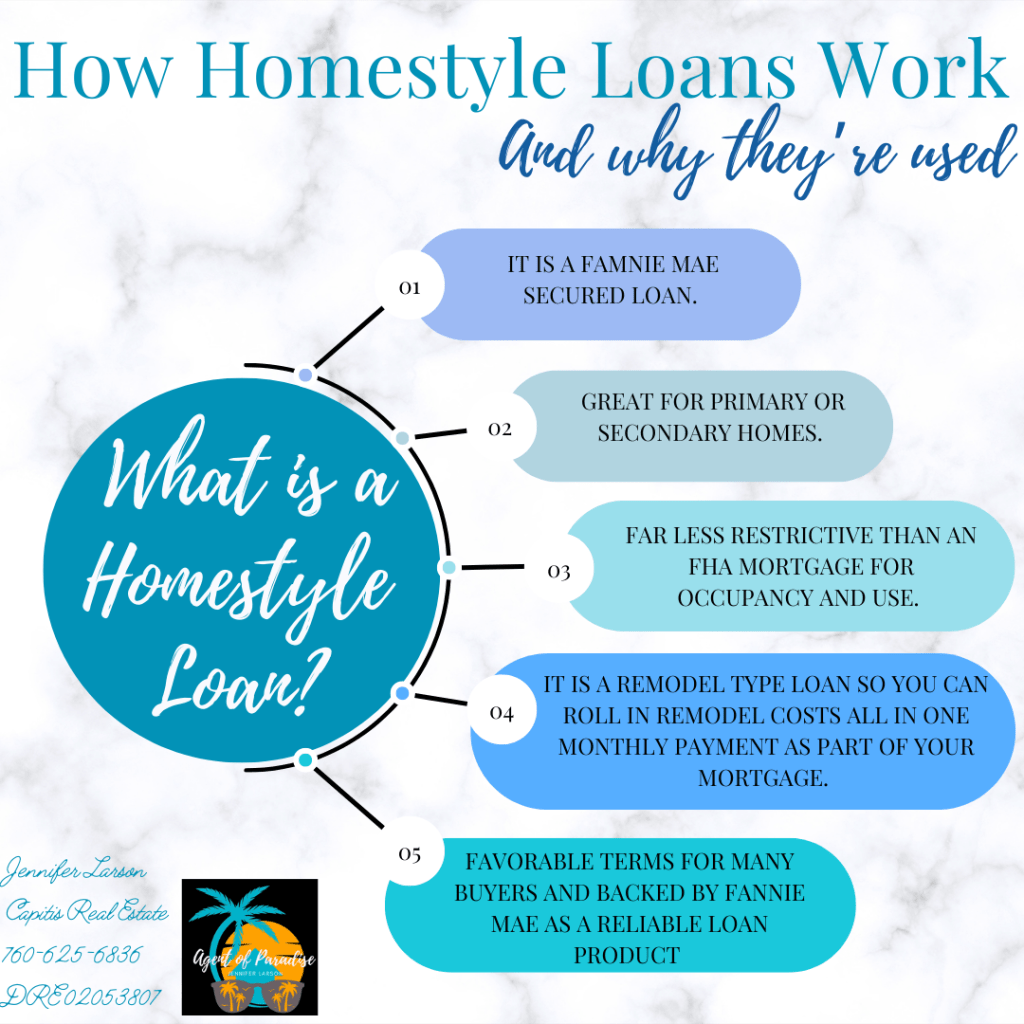

The HomeStyle Renovation Loan is one of my absolute favorites because of its versatility as a loan and tool for buyers with decent credit and DTI but not necessarily income yet. It allows buyers to purchase a fixer upper and get the costs of remodeling together in one payment in a stable loan program with oversight and streamlined financing of the projects. Here’s a breakdown how they work and what they are best for:

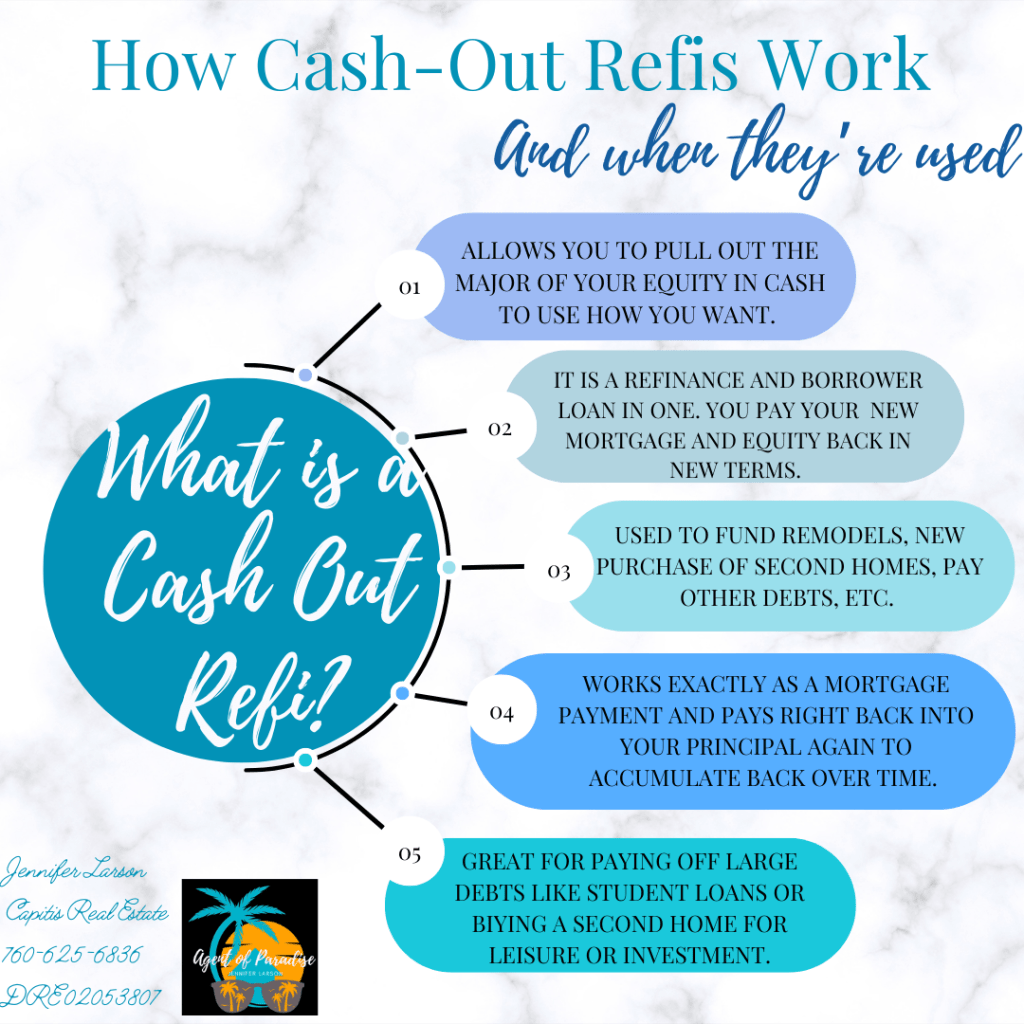

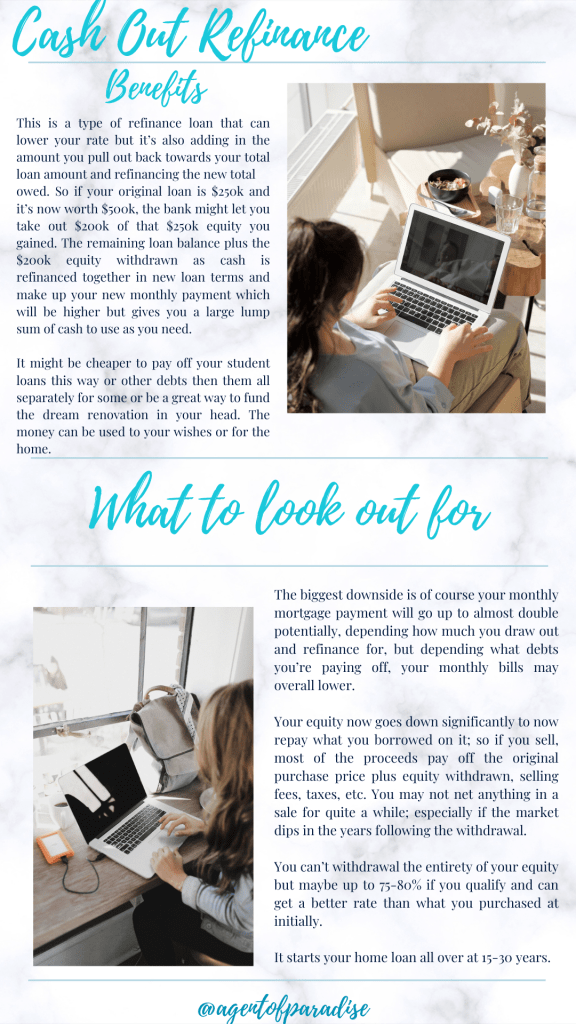

The next two are refinance and cash back equity options. The first is a Cash Out Refi, a refinance loan, that also allows you to take a majority of your home’s equity in a lump sum payment to use as you wish. Often people pay off debts, renovate the home entirely, use as emergency cash when they need substantial capital fast; or even for their dream wedding or vacation.

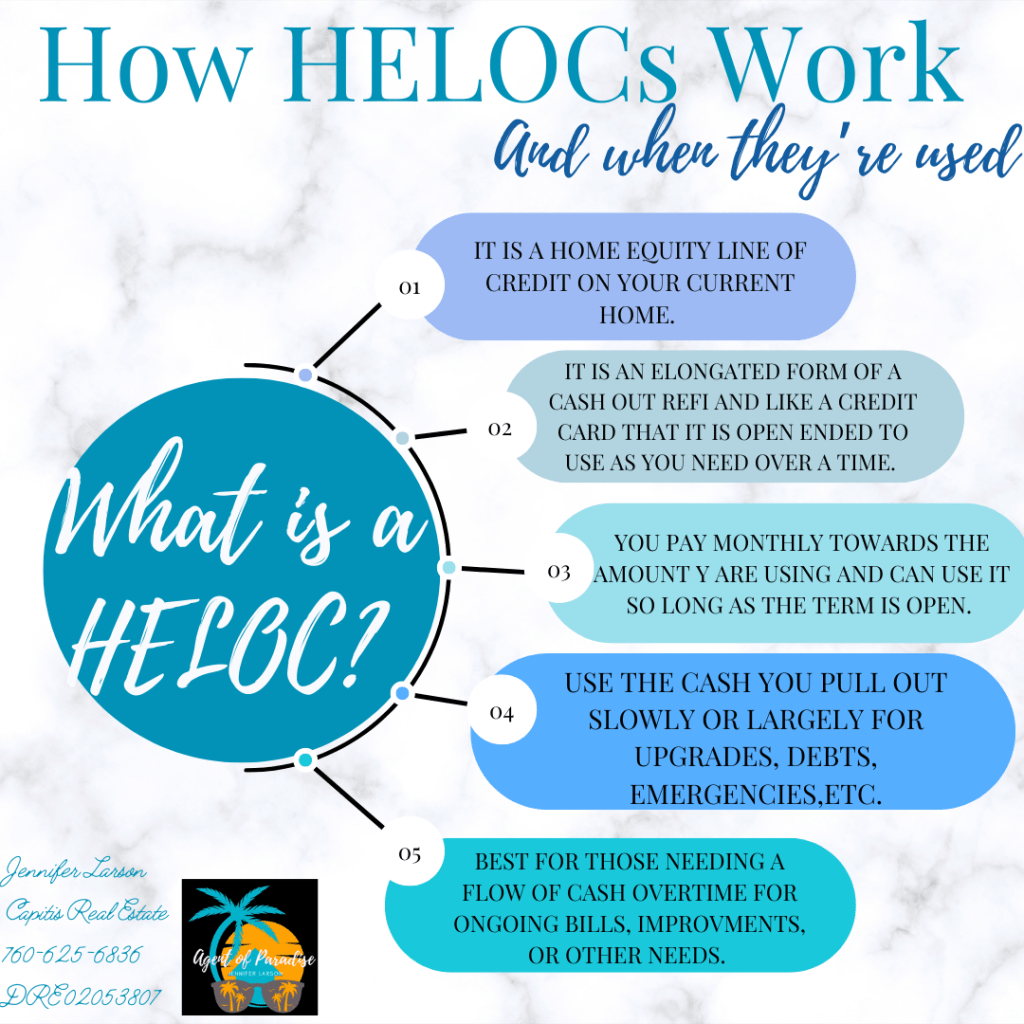

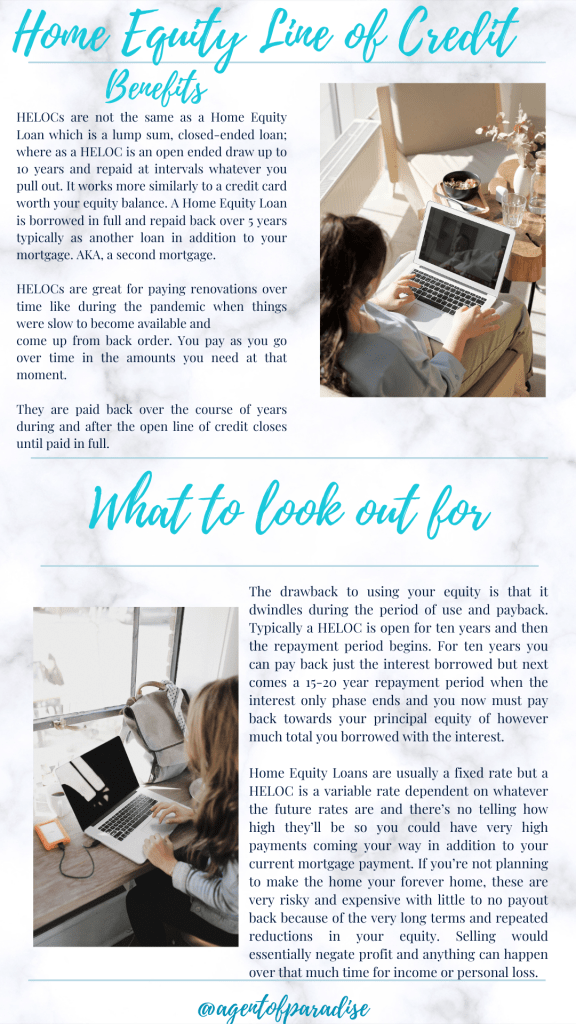

Lastly for today, we have the HELOC. A Home Equity Line of Credit, not to be confused with a Home Equity Loan, is an open line of credit on your home like a credit card that is valid for a decade as you need in increments and then closes to begin the repayment process.

It’s easy to overspend and over assume the future of your income and stability with these so be careful and really talk over a HELOC with your lender about the long term. HELOCs are not a good option if you will be moving anytime soon or while your kids are still growing up.

That sums up today’s post on loans and Refi products. More coming tomorrow for renovations, new builds, more information on ARMs loans, and more! Stay tuned.