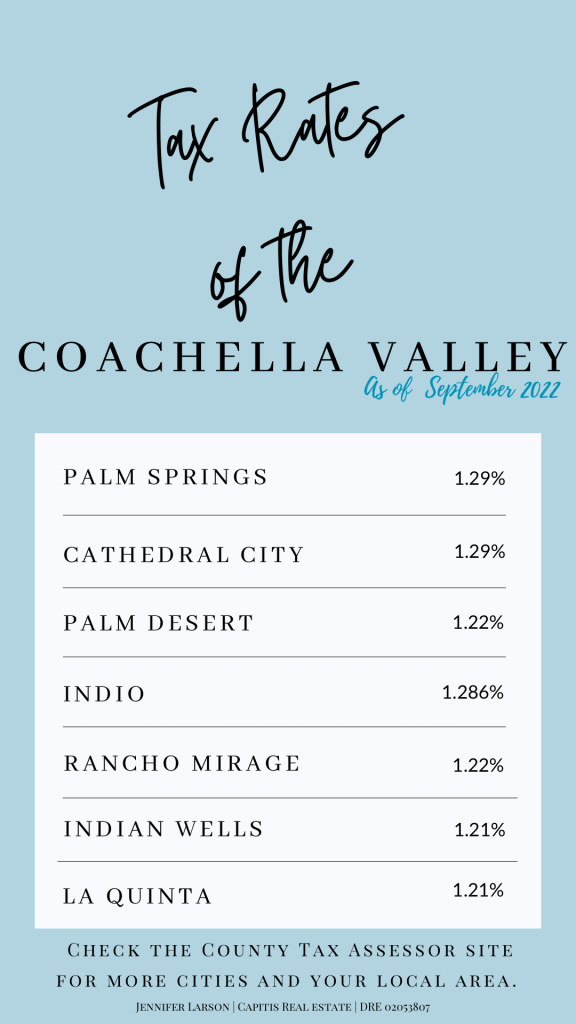

Here is a breakdown of the most popular cities in the Coachella Valley and their respective property tax rates.

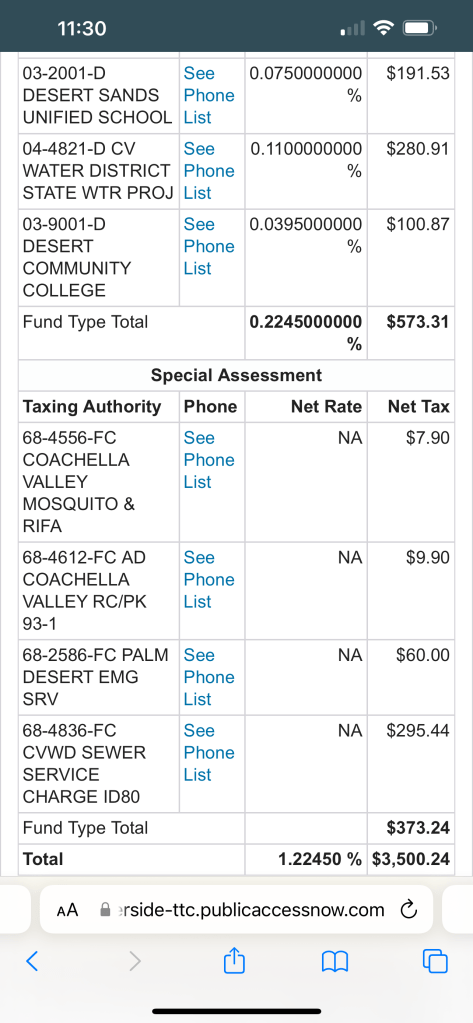

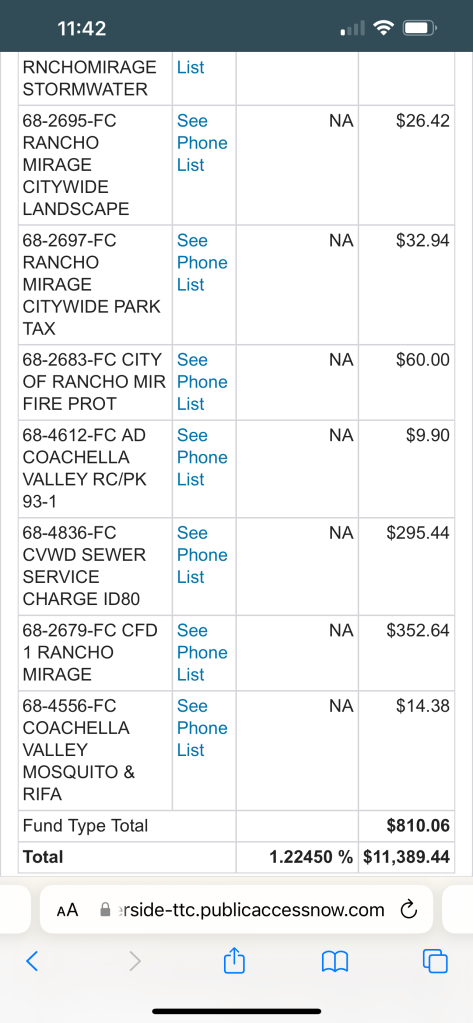

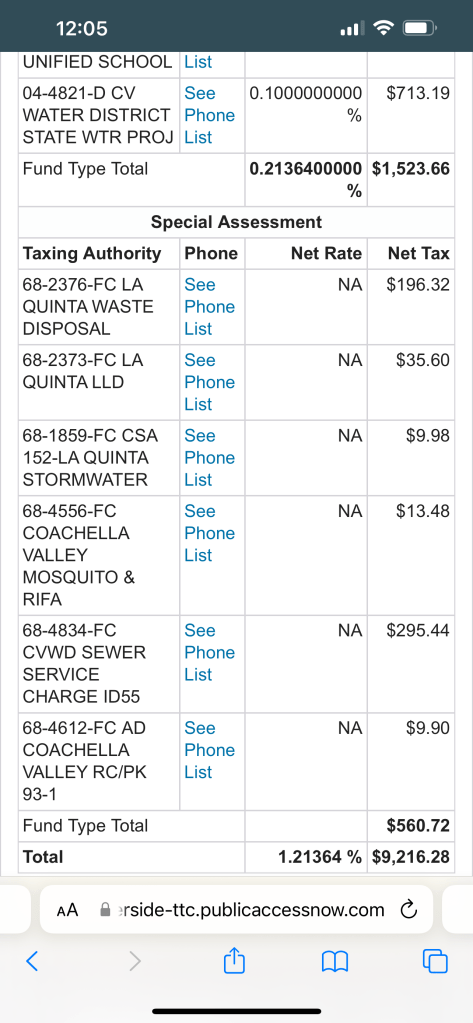

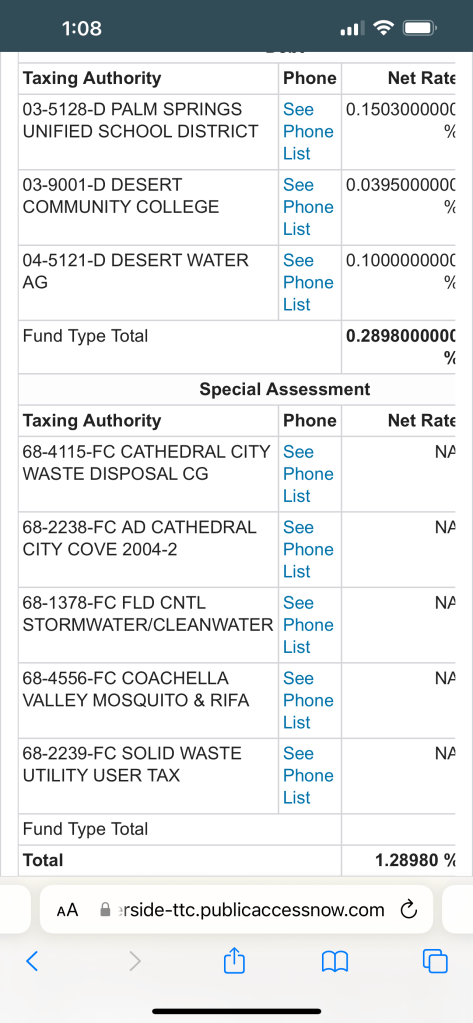

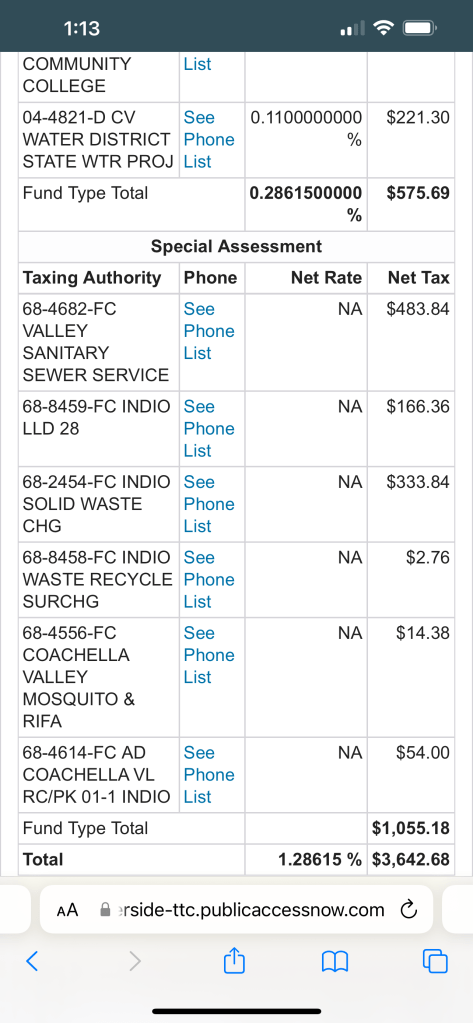

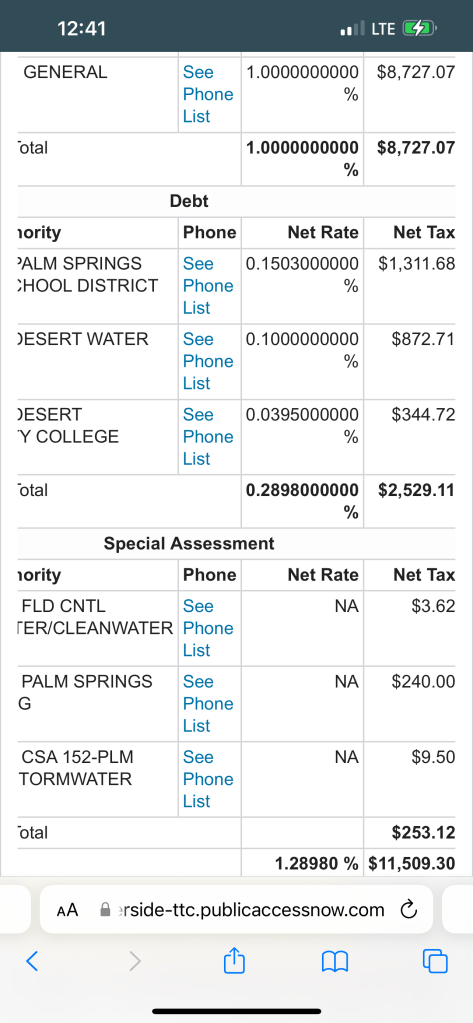

Below I will share screenshots of actual homes from the area to show exact tax rates and their breakdowns of how they are allocated to city services. You will notice the city of Indian Wells not only has the smallest tax rate but also the shortest list of allocation because it doesn’t allocate to any vector control, sewer services, parks and recreation divisions, or even emergency services as individual recipients. The city uses its general fund primarily.

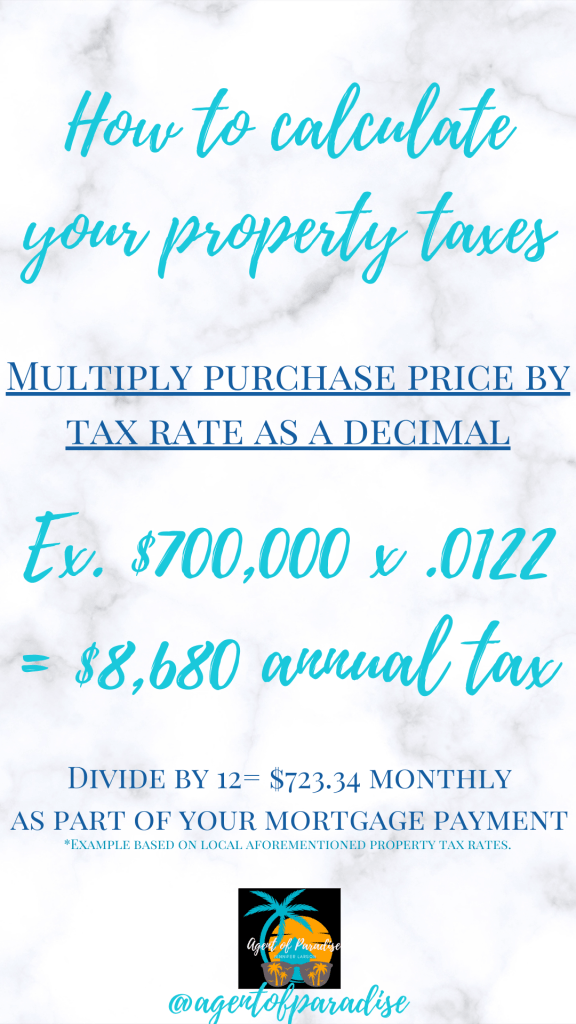

As you can see, property taxes throughout the valley vary and the rates will impact your mortgage payment as well as price at sale and slightly rise a little each year. So how do you calculate your annual and monthly taxes? Look below!

Remember that taxes go up maximum 2% every year, on average about 1%, based on the property’s last assessment (usually last price it sold at) until it is sold again and the new tax rate becomes based off the new sales price. Calculate your local tax rate off the purchase price of a home you are intending to buy. To look up local tax rates in your local area, visit the County Assessor’s site. For Riverside County here in SoCal: