Who wants to pay this much interest on top of their home costs? With rates being so dang high, lenders are shifting gears and offering up programs they haven’t in years at this level. They want to stay in business and know buyers want to save money and still take advantage of dropping prices; but how? Like this:

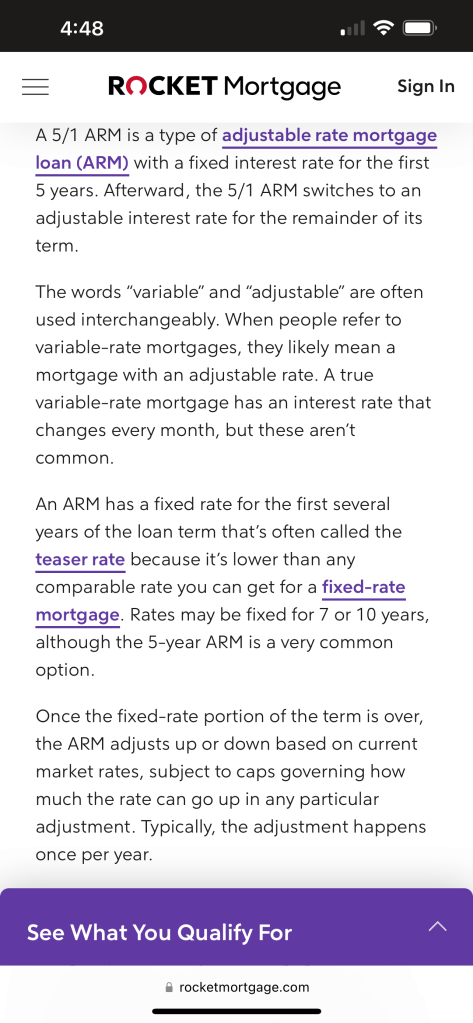

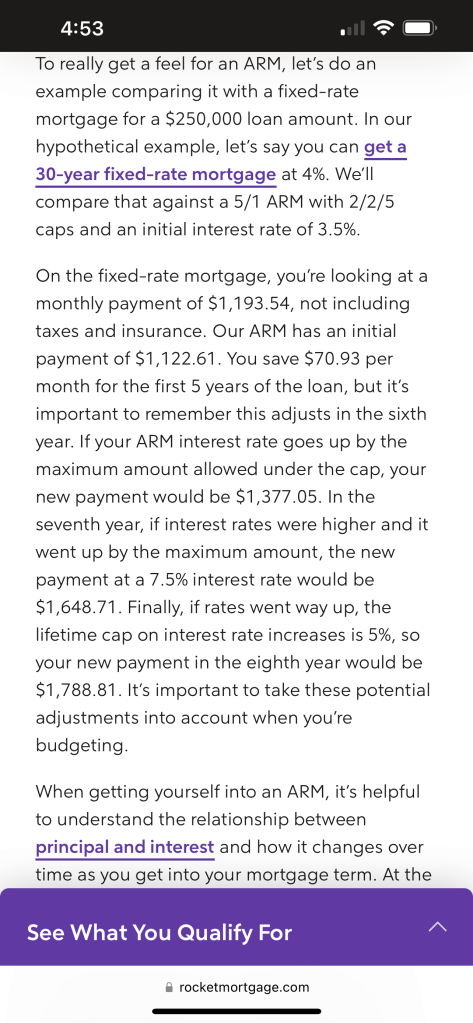

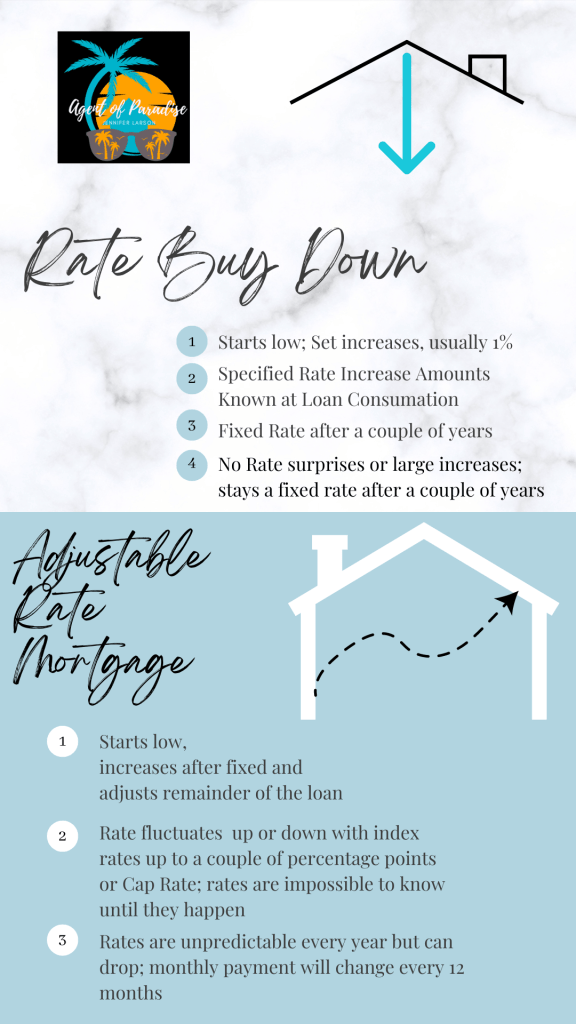

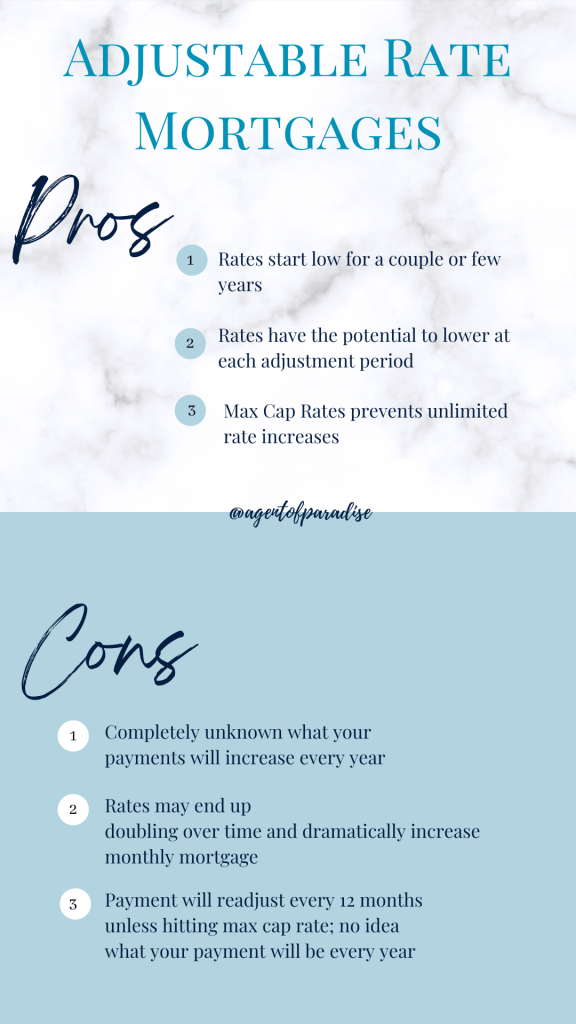

Here’s how they work, based off indexes in the future to determine what interest rates you will pay and those will determine your new adjusted bill.

What if rates get better before my next adjustment period and I want to take advantage but my loan doesn’t adjust for a while?

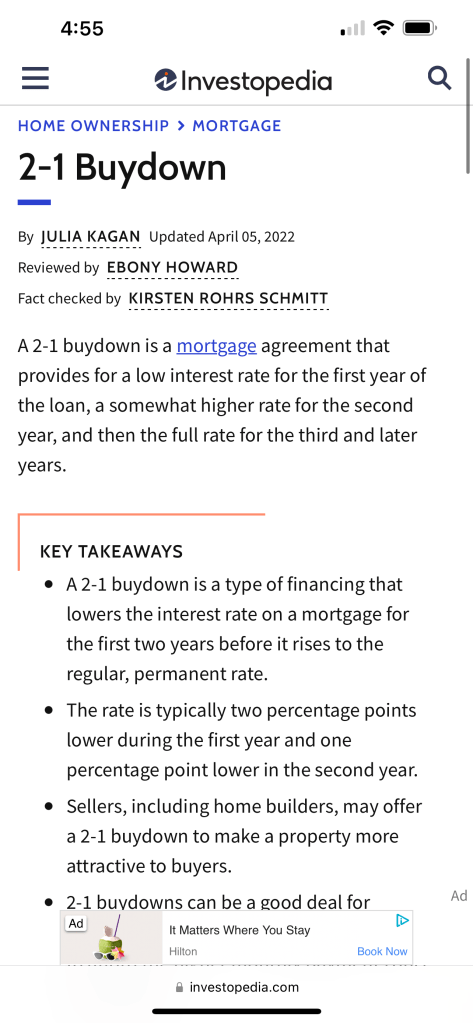

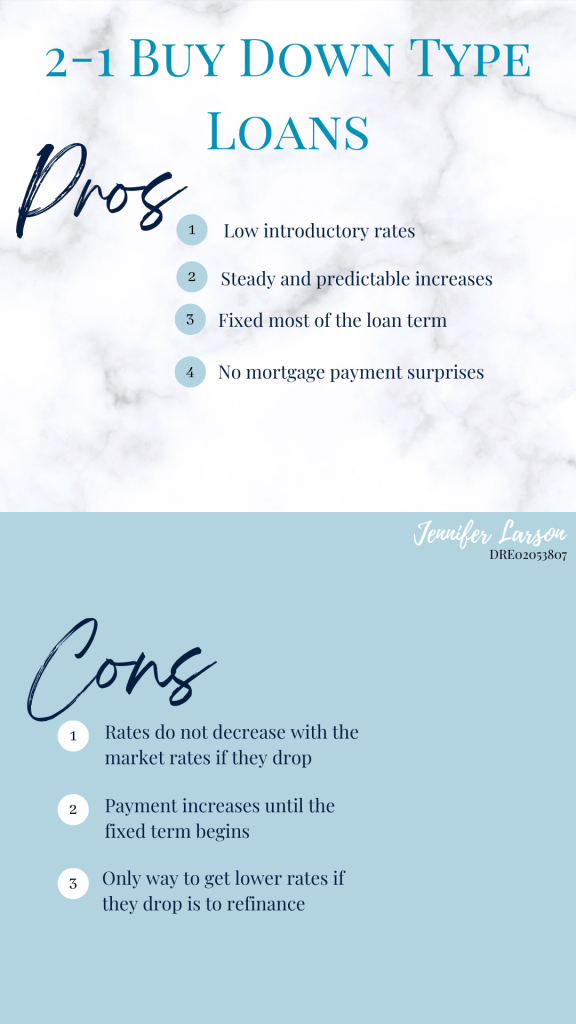

What about buy downs? Generally speaking, their up front cost is about the same as their overall savings, or a little better, but the monthly payments being cheaper and equity growing faster is what’s important to most people. They also don’t ever raise in cost so they’re a relief for buyers using an ARM loan worrying about potential rate and mortgage payment increases over the years.

Compare the two loan types side by side:

And go over the good and bad of each:

Have more questions or need lender recommendations? Call or text Jennifer Larson at 760-625-6836.