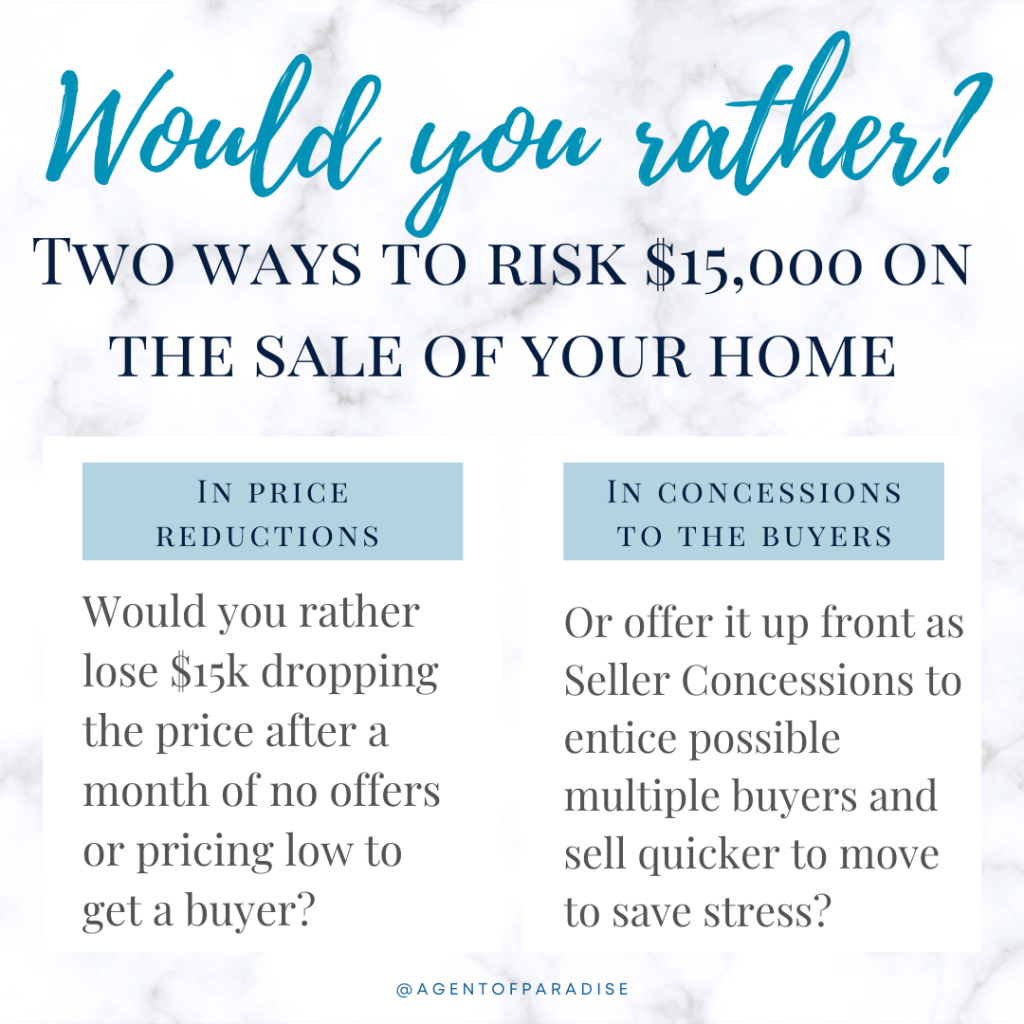

If you are prepping to become a seller in this market there are a couple of things to know as I stated in my last post. One of them is an adequate pricing strategy and enticing buyers financing to lure them in and pick your home over the competition. You can either do it to price lower or in subsequent price reductions over the span of weeks; OR, you can instantly offer in your listing to fund $15,000 towards the buyer’s lender to buy down their rate from around 7% to around 5% for a temporary buy down that helps them qualify better as well as save approximately that amount on their mortgage in just two years because they will have much lower monthly payments.

How does it work?

Lenders have a program called a 2/1 Buy Down (Temporary) that allows the buyer to either pay upfront or receive seller concessions for the cost to lower their rate 2% of the current rates for the first year and 1% off the next before fixing to current market rates in the third or refinancing if rates have dropped since then. The amount saved in monthly payments allows them better chances of approval and amount as well as monthly easing their mortgage burdens. As a seller you can help them even more by saving the upfront cost of the buy down so they truly save the money short AND long term!

If you’re a buyer you can ask for a lump sum to help buy down your rate and save money over time and each month by doing so even if you pay list price without further negotiation. It’s leverage to you and when deciding which property to go with if you need to narrow it down. Save a lot on your next home and get the house you want with more affordability. Win, win.

For more information on buy downs, I can help and get you to the right lenders. Call me!