Sellers and agents are learning in this new market that first time buyers in particular struggle to understand what a rate Buydown is and how it benefits them; often choosing a price reduction over a Buydown thinking it’s saving them a lot of money. It is but not nearly as much.

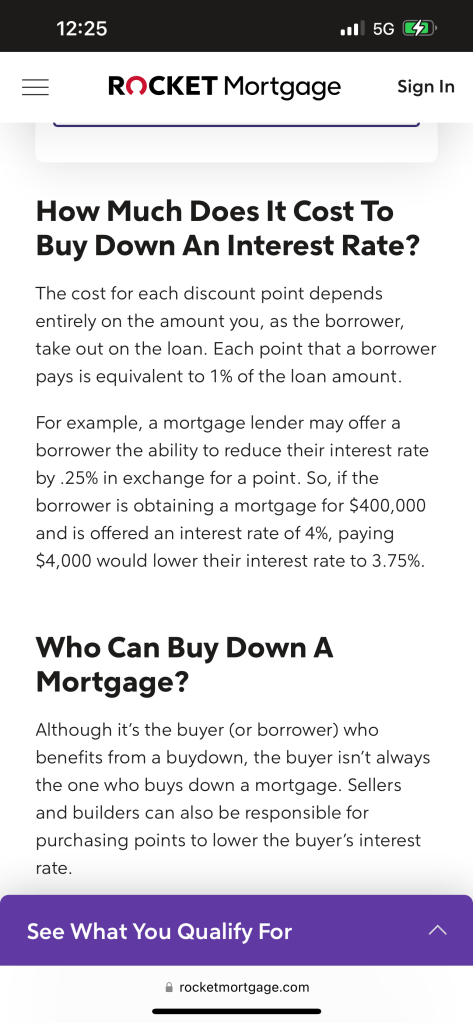

There are 3 main types of Buydown scenarios but the two buyers need to know are the 2-1 and 3-2-1 programs. These are what actually save you money on your mortgage and over time because rates are what drive a mortgage payment so high; not sale price as I have mentioned many times before. Taking $15,000 from the seller towards saving money on interest will lower you payment a lot while a $15,000 offer under list won’t save you much at all. So when your monthly payment is significantly lower every month it gives you a greater quality of life and ability to put money away. It puts money back in your bank account.

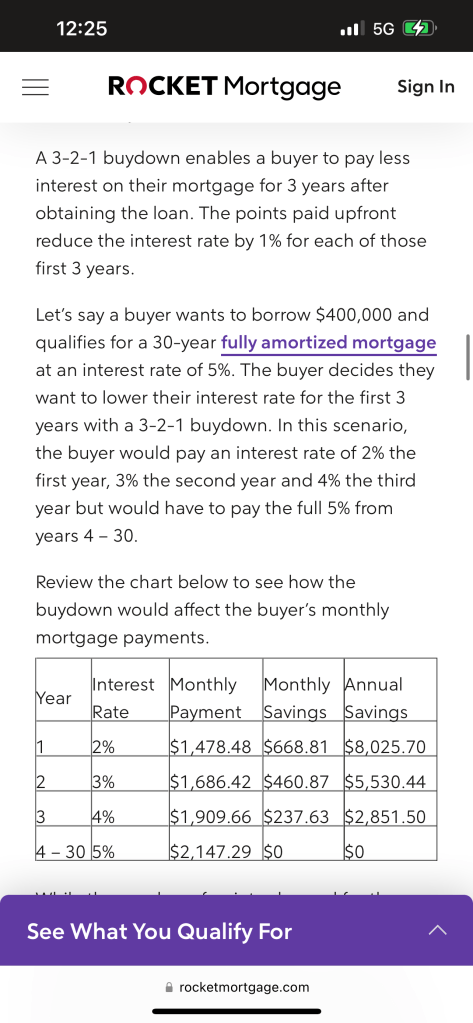

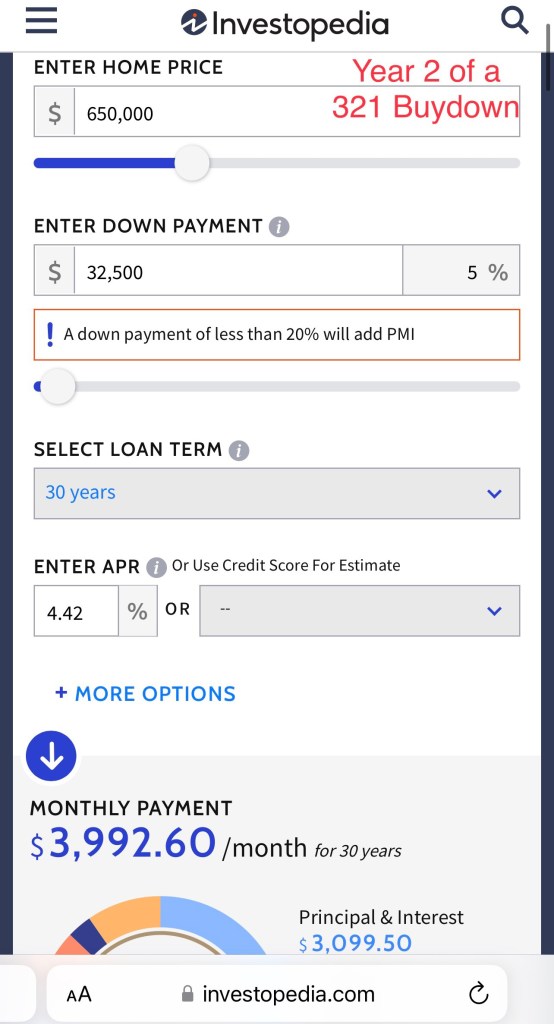

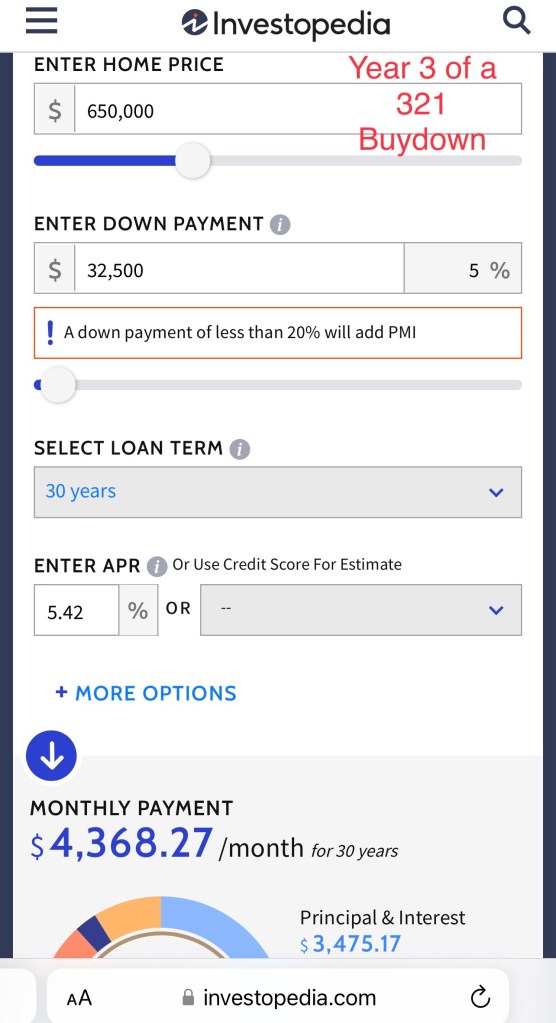

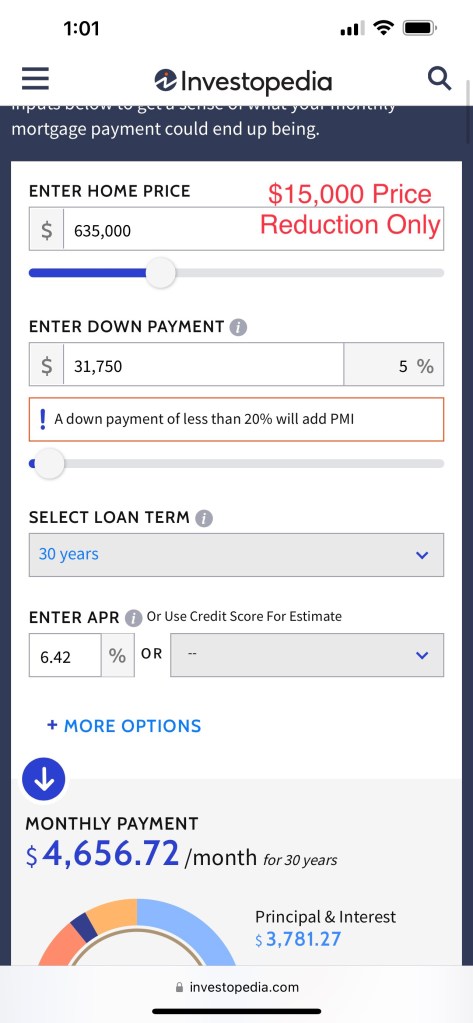

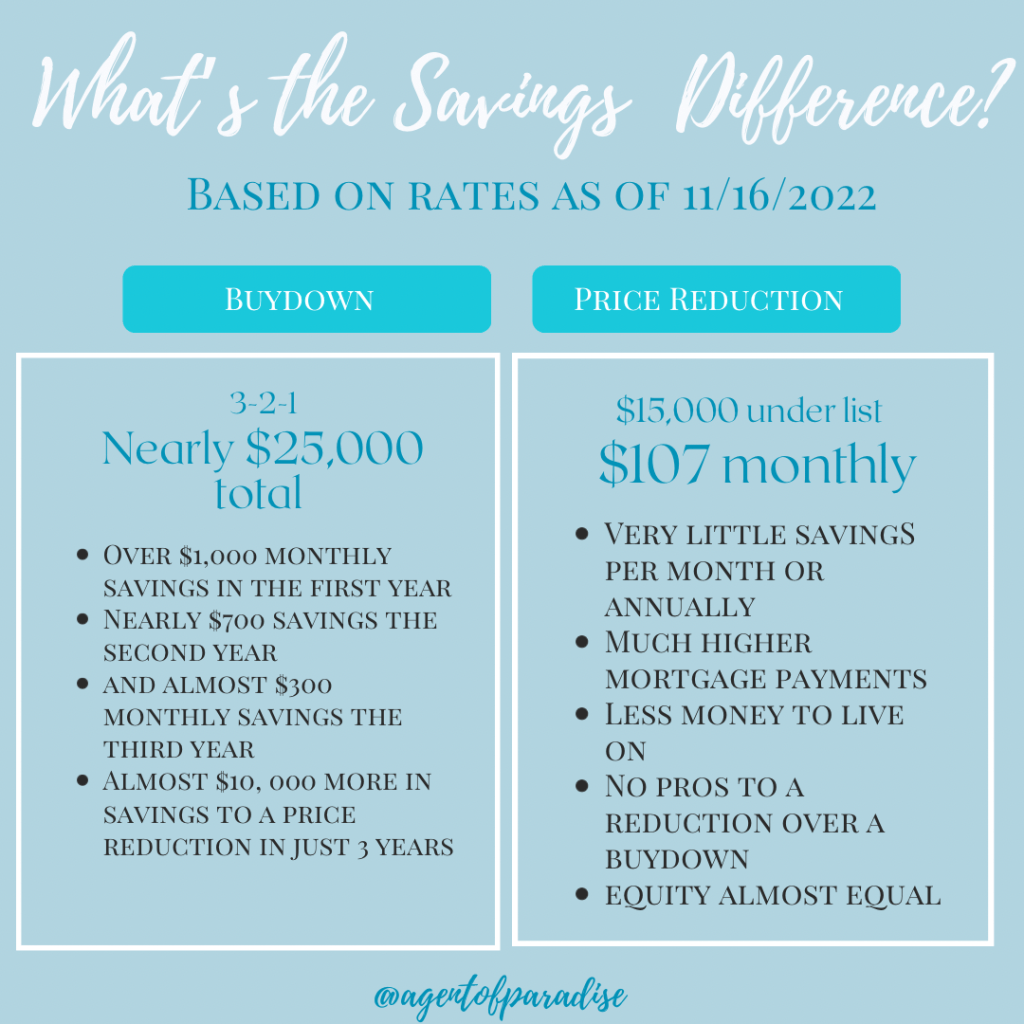

A price reduction of $15,000 will only save about $107 monthly while $15,000 for the lender to Buydown the interest rate up to 3% from current rates equates to a monthly savings of over $1,000 each month in the first year of buying the home! In one year alone you would save over $12,000 on mortgage payments!! That’s like a $12k raise. In your second year you’d save nearly $700 each month on your mortgage. That’s an additional savings of over $8,000 that year! In two years you have already saved over TWENTY THOUSAND DOLLARS on the same loan and income!!! Your third year would save you over $3,000 that year!! If you added the exact savings in the first three years from a 321 Buydown it would equal very close to a SAVINGS OF $25,000!!! So you save $10,000 more than a price reduction in the very near future after purchase AND after three years you can even refinance to lower rates again if Refi rates have dropped since your home was purchased.

The savings are endless and this is why agents and lenders won’t stop talking about Buydown programs. We’re not selling you BS. We’re saving you tens of thousand for FREE!!! You essentially got a great raise by buying a home and it was paid for by a stranger just desperate to move. You can also do just a one or two year Buydown for a little less money from the sellers if they won’t put forward the $15k-20,000 needed.

If you’re a buyer looking and you are still confused or need more additional information on how this works and why it’s far superior in savings to negotiating a sale price, make sure you give me a call or text right away so I can further explain how it works and show you more math examples why it’s better to get the money as a rate reduction versus a price reduction. One saves twice as much nearly in just 3 years. Contact information below.