Most people have this problem because money is hard to come by obviously. The answer to this age old question is throughout my blog and Instagram actually because it’s multi-faceted. You need the right savings and checking accounts like the MMA and HYSA and definitely a CD or two to keep that savings out of reach for spending but still earning great profits on your money. Those are all tools to grow your money.

To get more money I constantly share savings plans like $5 HYSA contributions or $100 per month, or swapping your streaming and television services for deposits into your account because that’s how money grows fast and gives your more time in life for the things that matter. I share a more efficient plan for those who can afford up to $250 per month and I share how to get to that and make the right cuts and changes to minimize the impact on your life but also maximize the impacts on your financial future.

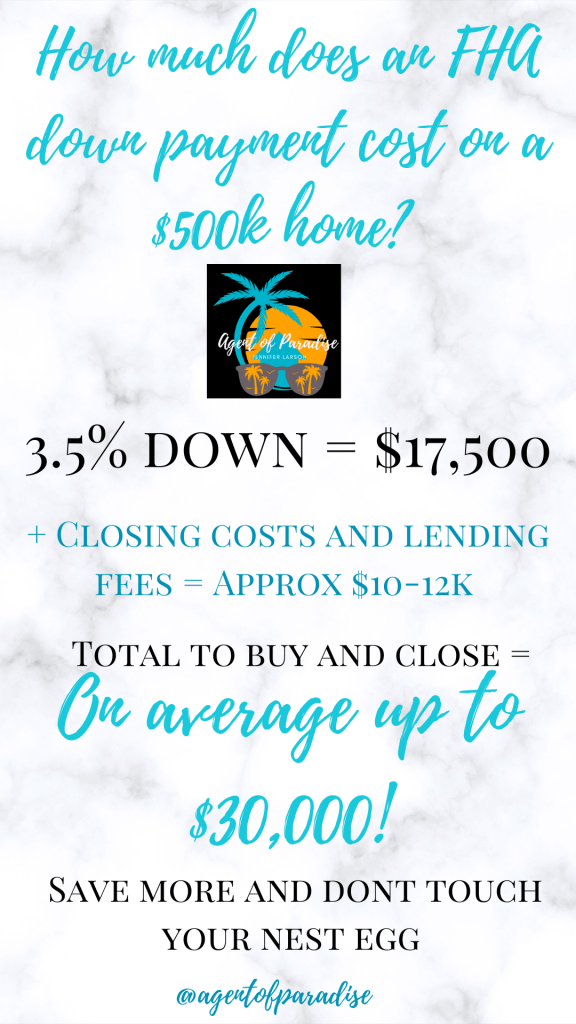

How much do you need? Well, here’s a starting point to consider:

If you need a personalized savings plan, send a DM to @snowplowsanscacti and I can help you there.