ARMs can get very expensive and these loans often are based on the PRIME Index (the Fed Rate) but even when the Fed lowers the rate a lot, you’re still paying a margin over the Fed Rate. The Prime Rate could be 4% but your ARM could still mean you’re paying 6-7% because of your margin on your loan. The Fed Rate is the base of the loan but rarely what you actually pay. You can get low rates in the beginning of ARMs and refinance as mortgage rates drop, if you qualify and have the money, but otherwise you’re stuck in them and they can rise to 10% easily at a lifetime cap. Be careful on these.

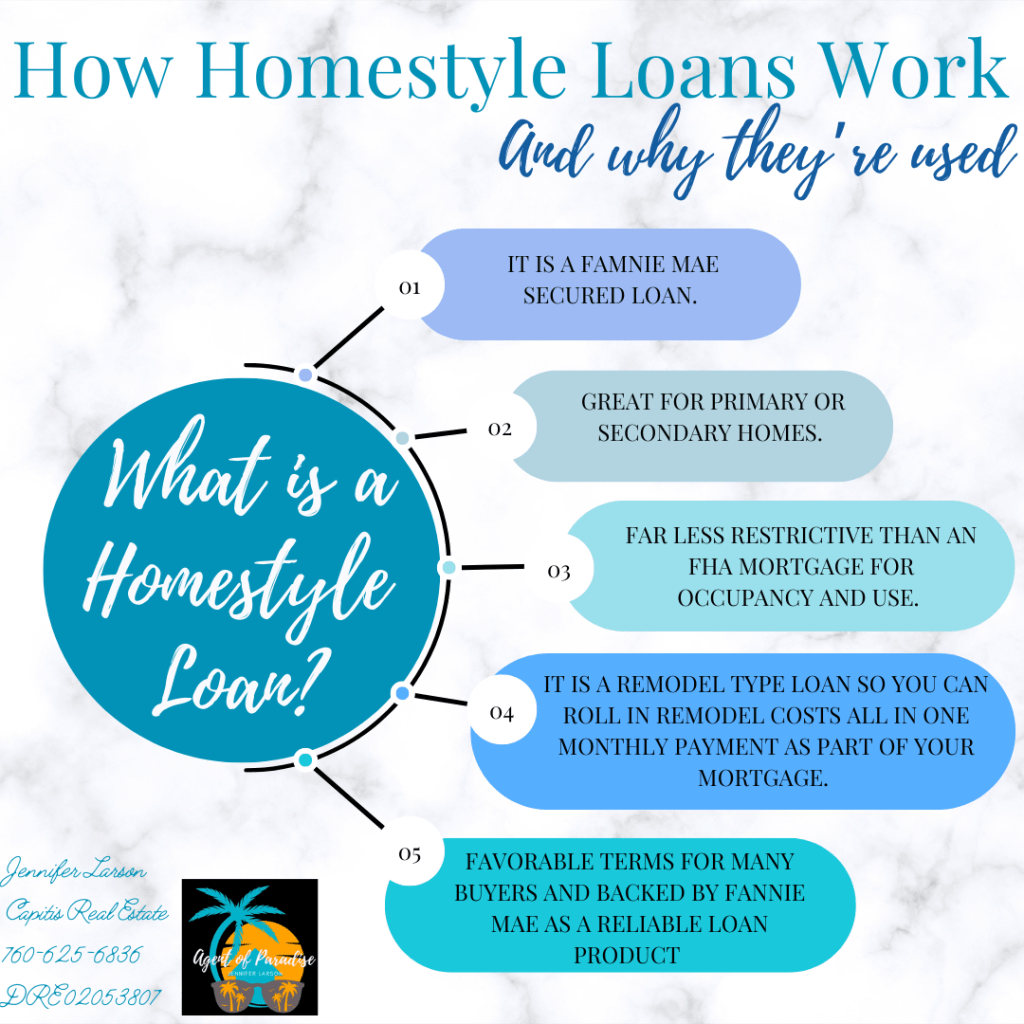

HomeStyle Loans are great because even though they are FHA they don’t have the rules and regulations of FHA. From day one you can use them for STR, flips, LTR, etc and they roll in the construction costs and they actually force the GC to be accountable. These loans require a 6 month turnaround, only approved contractors and engineers, they disperse the funds based on work completed, and they do lots of inspections. I like these for the average person even if they don’t want to invest. They’re fantastic and in less expensive markets, they’re going to cover a lot and help you find a home you actually want to live in, that might currently be scary to consider.

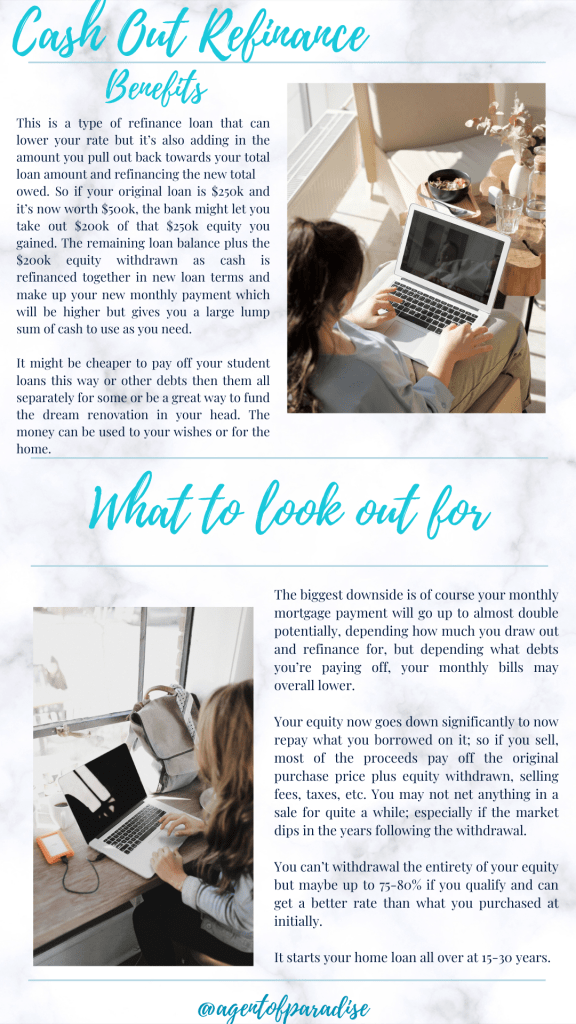

These can be great if used right and you’re smart with how you plan because it’s a loan against your home’s equity so understand you have to pay it back with your mortgage. Basically you refinance your house at its current value which is a lot higher and you after fees and taxes you get about 75% of your equity in cash to do as you please. This is where you need to be smart. Since you now have a bigger house payment don’t go buy more things. This should be used to pay off student loans, pay down all other debts, buy an investment property or pay one off, or you can use it to out kids through college etc, but be smart. It’s not free money and it can wreck you quick if you don’t get smart with it.

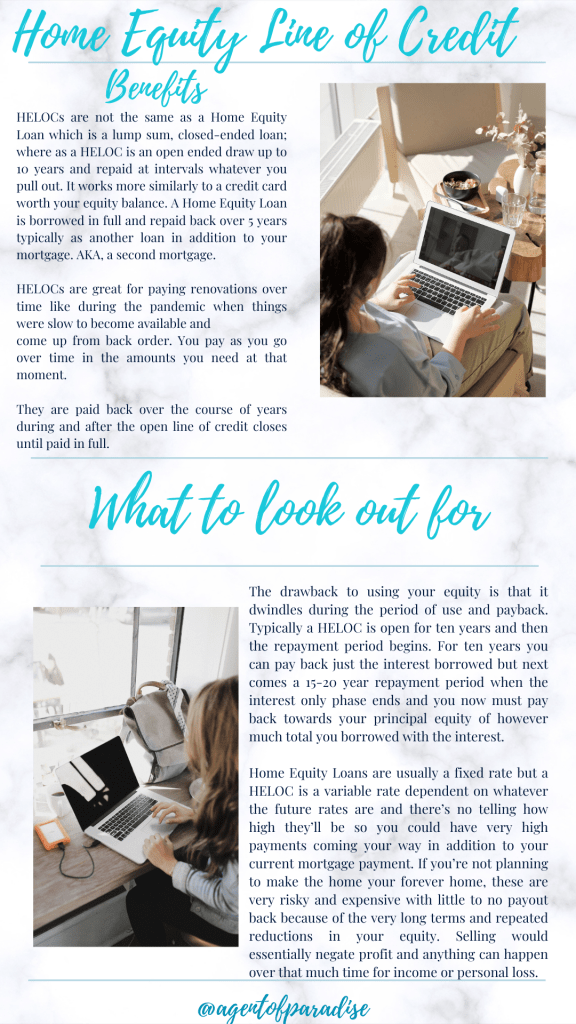

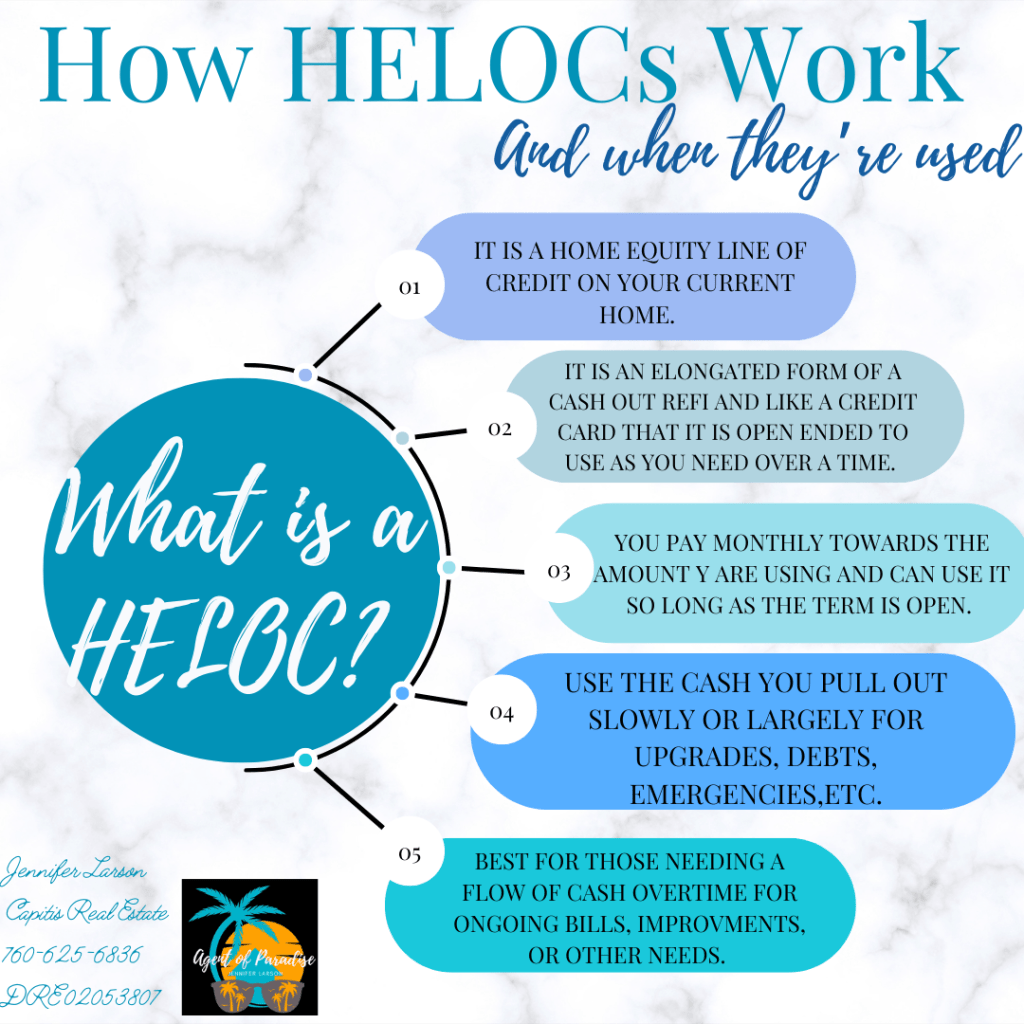

This is basically using your home’s equity as a credit card 💳. You can charge it up as much as you want and as long as you pay on it, for a decade you have this extra cash to use. However, like a credit can get you in trouble imagine how much trouble and debt you can incur with a six figure credit card limit if you’re being stupid with it. Again, this is best for life expenses like paying off all your other debts, student loans, renovations that put the equity back in, some do use it for weddings, paying off medical bills, using it to travel, etc. Have a PLAN with this and remember it’s a big credit card bill every month if you’re not using it wisely.

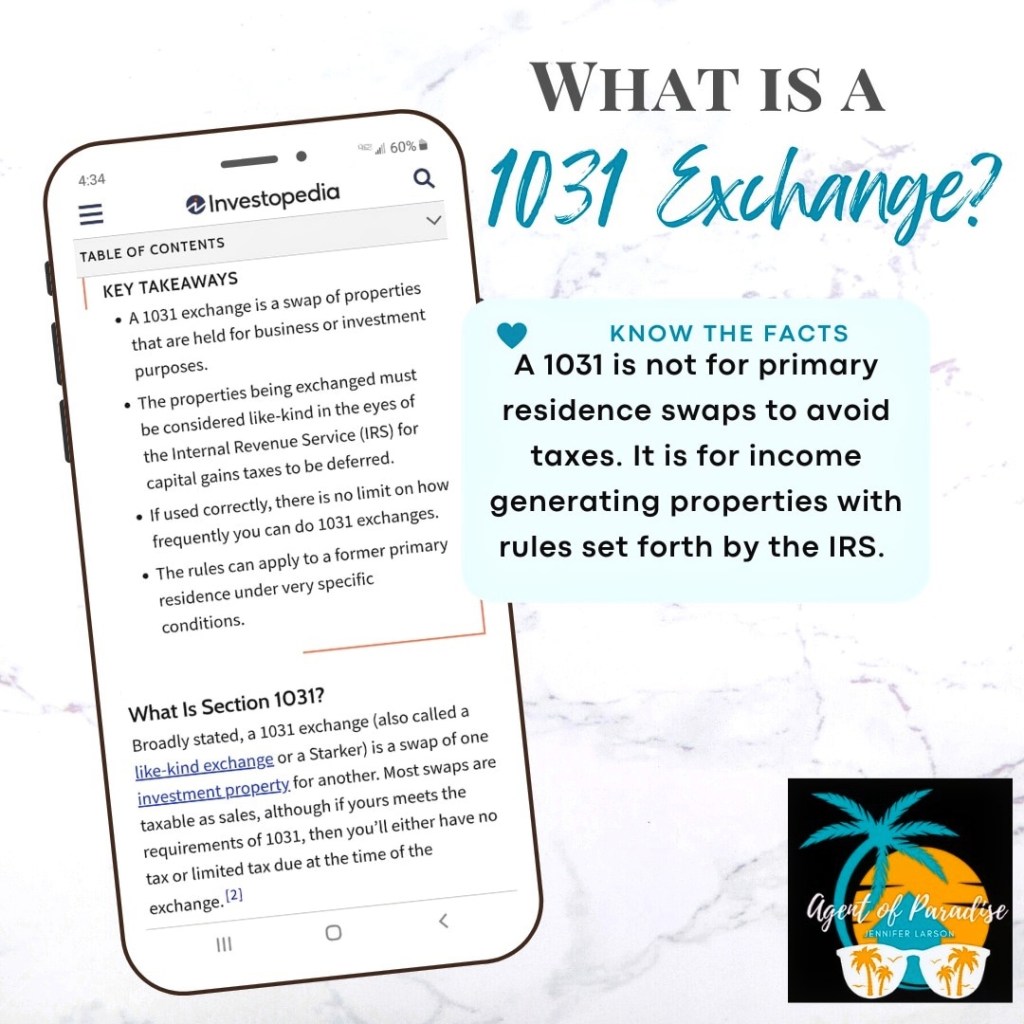

I have done these with clients and they work the same for us as agents on a 180 day deadline which is more than enough so long as you know what you’re buying, and get into contract relatively quickly. Escrows do get extended, canceled at the literal closing (been there) and other things can fall out and you have to start over again, maybe even with your home search and loan. I’ve had escrows that were supposed to close in two weeks suddenly take 4 months, multiple times. This kind of home purchase requires you to be smart with your time or you mess up your finances. You also need a 1031 Exchange agent because this is what’s called a Tax Deferred Sale and there is a lot of backend paperwork involved. It is a good option though!

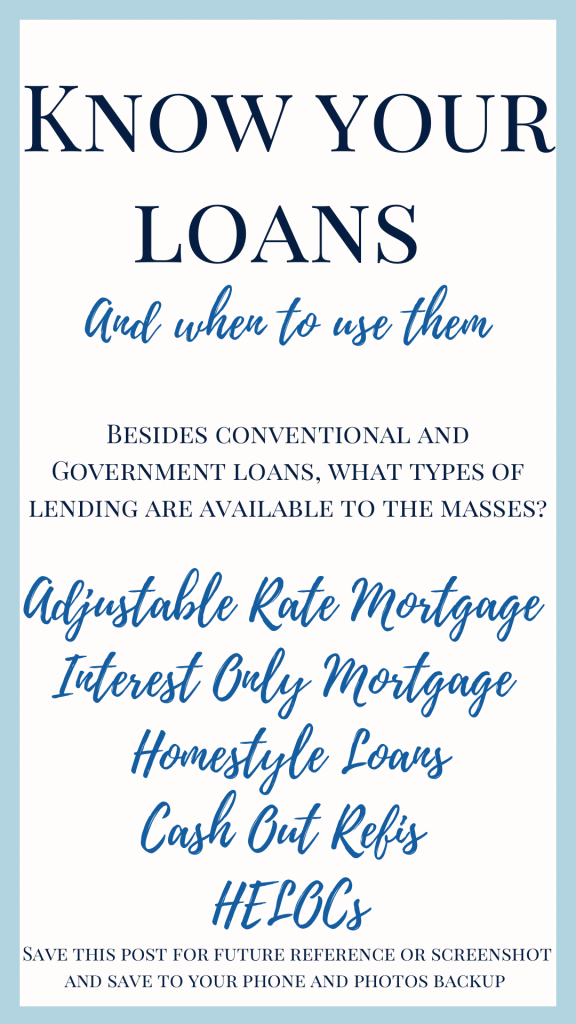

Of course there are way more programs but these are the ones many people know but misunderstand the most in my experience. A good lender will show you all the options!!