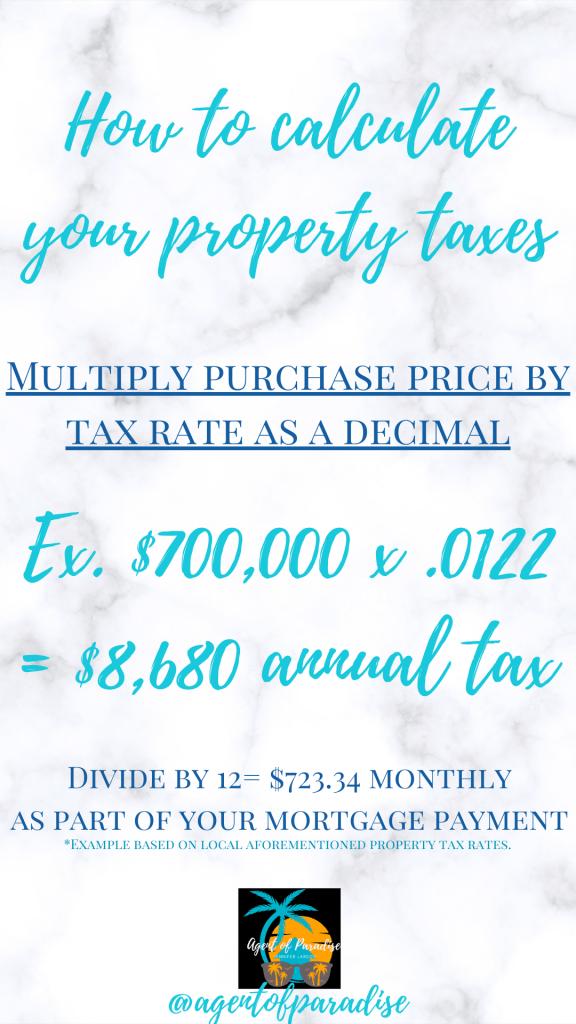

There are phone numbers listed for you to call if you have questions regarding your tax rate and tax bill. Here’s a quick snapshot how to calculate your taxes and estimated amounts when buying a house or confirming your amount due:

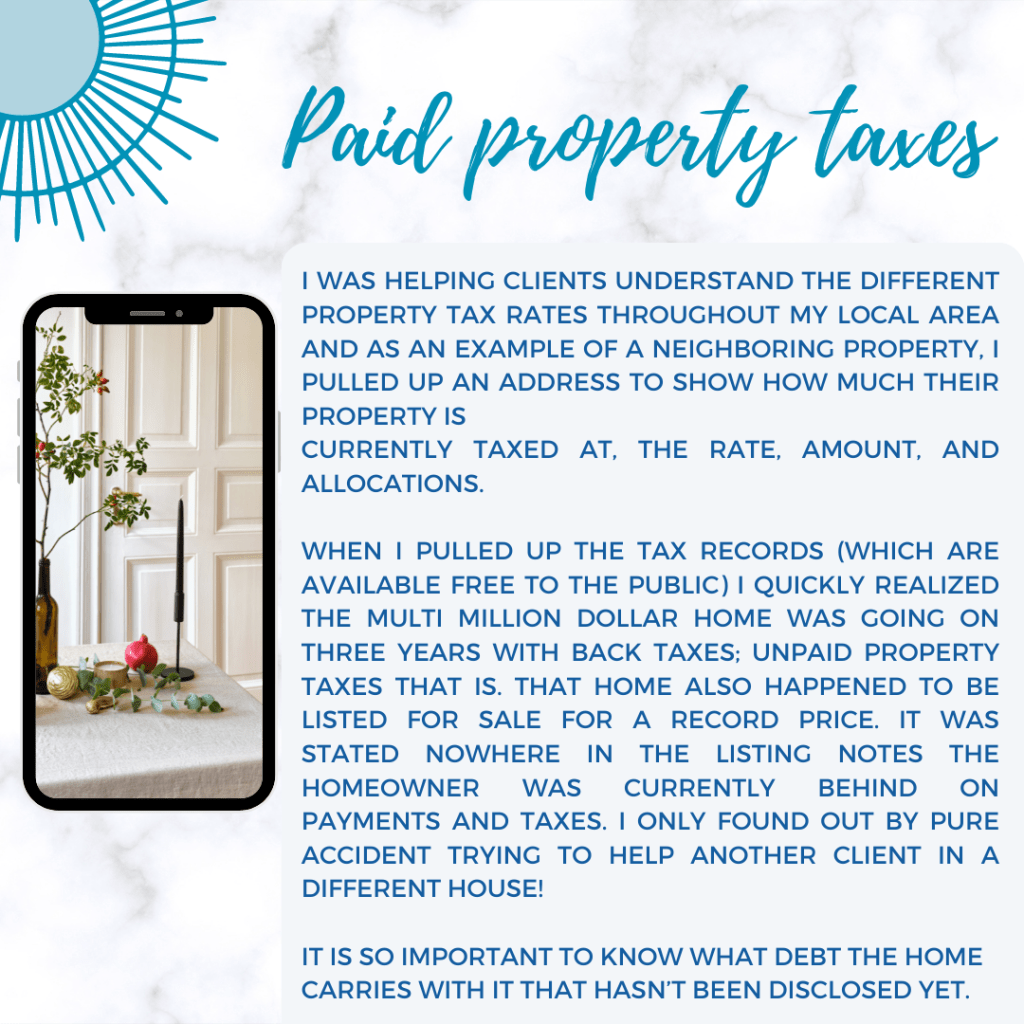

Check your statement! And when buying a home make sure the current owner is up to date on their taxes!! Here’s a real life example I found while checking a property history:

Always check the property before buying and run a preliminary title report with your agent before offering or ASAP afterwards. Sometimes the seller will also have HOA liens too and expect the buyer to help their financial woes at escrow! As a buyer I wouldn’t negotiate to help cover a seller’s back taxes but some have a lot of gulf and will absolutely try to insist the buyer cover part of the bill during negotiations because those liens have to be paid to the county and city before escrow and the county recorder’s office will allow the sale to happen and transfer the deed. The seller may also not disclose it before asking for the concessions and many agents may not even look it up before listing so they’re unaware at contract.

Things to be aware of!