This is the actual approval process of your loan and when you’re actually going to be determining eligibility for the loan you applied for. This is a deep dive into your account history and all of your finances, line by line, and everything on your credit report. They’re doing an investigation basically into your employment status, your balances, your credit usage, your past history, and everything else.

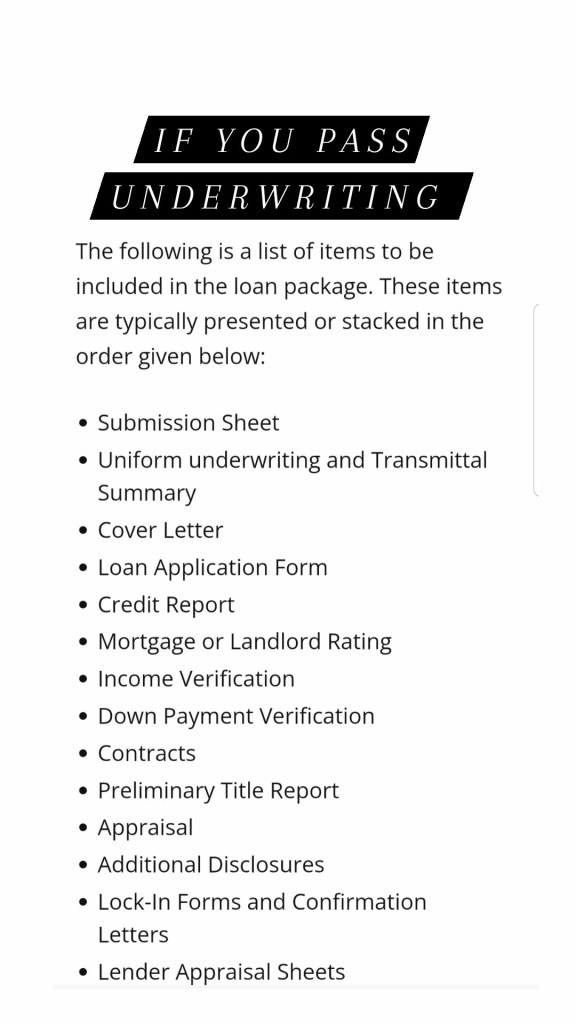

A lot of these begin right away but basically coincide and are part of the bank decision making the loan or not. How does the home appraise, what’s in the title chain, and verify everything listed on your end and the rest about the property. If you get past all of the above and underwriting, you’re good to go usually.