Get your current bank account ready and follow this link to open a free and easy High Yield Savings Account. You’ll earn at least 10x the interest and get your money flowing separate from your debit card. This is just for savings! If the link expires, just email jenniferlarsonent@yahoo.com for an updated sign up bonus!

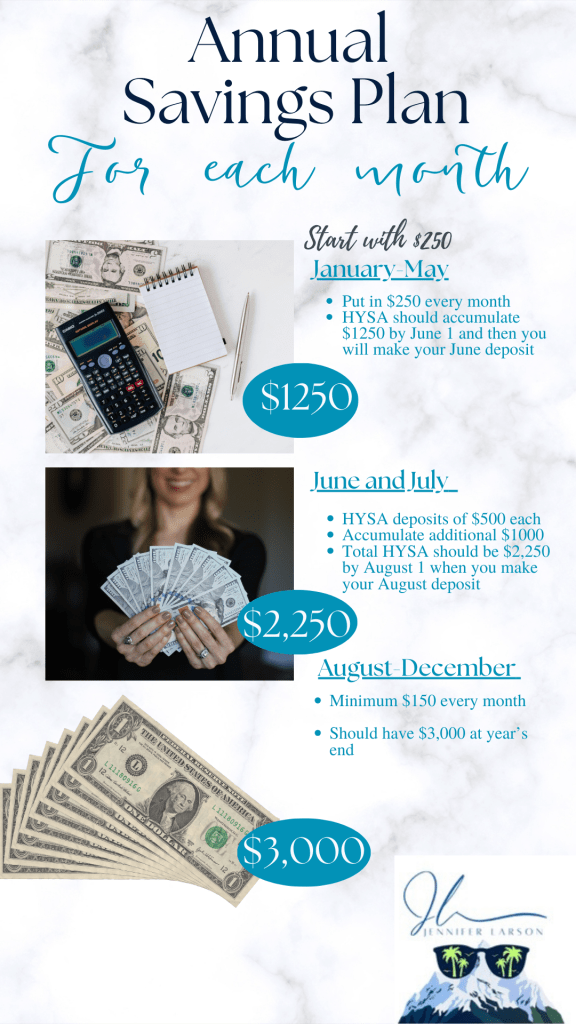

Deposit $100 from your current bank account and start there. You don’t need to open a new checking account or move everything. SoFi will automatically give you a debit card account and you can use it if you choose or keep the HYSA as your main account there. You can also automatically schedule deposits every pay period to put $100 every time. This is what I did to start my account and grow slowly. I really love this savings plan to build an account balance and start small. Over time you will want to grow this more but this is a great way to start and turn $100 into $3000+interest every year. Whenever you’re reading this, open the HYSA with $100. On the first of next month, begin following the schedule wherever it is in the year. You’re going to follow this plan when the new month begins:

If this is a difficult schedule to follow in the beginning check out my Beginner Savings Plan to get started before moving up to this plan. To get me new and updated Standard Savings Plan Full Version, you can get your free booklet by emailing jenniferlarsonent@yahoo.com and I will send it to you.

At the end of every year, you can also look at CD rates. Some have a $5k minimum but others will let you turn your annual HYSA balance into a CD with a little bit more APY and since you can’t touch it, you won’t spend it! This allows banks to use that money and grow. As a result they pay you more interest on the Certificate of Deposit. After the CD term you can put it back into another CD if rates are still good or just transfer it back to your HYSA until rates improve. They vary with the Fed Rate but usually are always much better than regular accounts. Then repeat for the next year. You’ll have over $15,000 at the end of five years. That money can continue to go into CDs and grow with interest without you doing anything. You’re letting your money “season” and marinate in interest and it’s safe from being spent.

There are other ways to grow your money very affordably with a financial advisor. You can use the free service on SoFi or other companies like Edward Jones and invest there. They are NOT expensive to use and they make money when you do. They make you more money than when you walked in the door and many account holders get them free even with a small balance. That’s their job and everyone should have one. You don’t pay for things you’re not invested in so it’s absolutley free to consult and gain information. They’re commissions come off the sales of stocks and funds. There are a lot of low risk and low cost mutual funds that can give you even more ROI than an HYSA or CD but it’s best to go over that with an investor who looks at those numbers every day. I have a few but not all are as good and a couple I am currently moving to try better ones. I definitely didn’t lose money and my account does grow every year but I want it to grow even more! Basically, I want to beat my HYSA and CD rates by at least a percentage point.

I currently am buying VOO and VTI on the SoFi app in flat dollar amounts since they’re a little pricey. They are ETFs so cheapere and more tax efficient than mutual funds and pool some of the best stocks in history including Amazon, Microsoft, Apple, and new rockstars like Nividia.

For personalized savings and credit plans DM me on IG @snowplowsandcacti