Should you roll in your down payment to your mortgage?

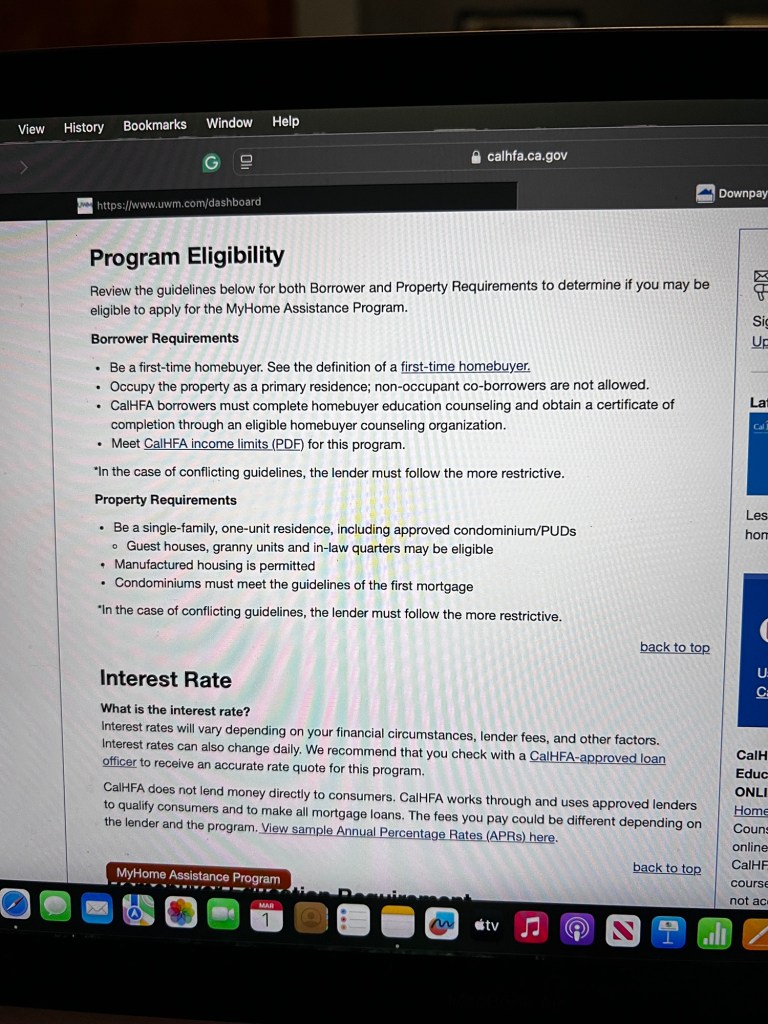

States and counties have their own down payment programs so talk to your lender about your specific area and file. For example, California has the CalHFA loan programs for conventional and FHA loans.

The type of program available in your area and the home you’re buying can determine what type of down payment assistance you can receive and how much. Some programs are grant-based, others provide only a small bit of assistance so you need to cover most of the down payment still, and others are paid off as a junior loan when your home is sold again down the road (the one you’re planning to buy currently). Other programs roll in the down payment into your mortgage which can greatly impact your approval amount and raise your interest rate. Since these programs and terms vary so much by zip code and client, it’s important to speak to a lender local to your area and discuss your affordability options.

If you need an agent or lender anywhere in the country, you can call/text or email me:

(760) 625-6836 agentofparadise@gmail.com