Have a plan!

We’re going to discuss multiple ways to save for a down payment but every buyer will have some sort of action plan. For those fortunate to have an income that provides the ability to save more readily than most, their action plans might be as simplistic as knowing their total cash reserves needed and applying for the loan rather quickly. For most borrowers, your approach will need to be more structured and take more time to realize those goals.

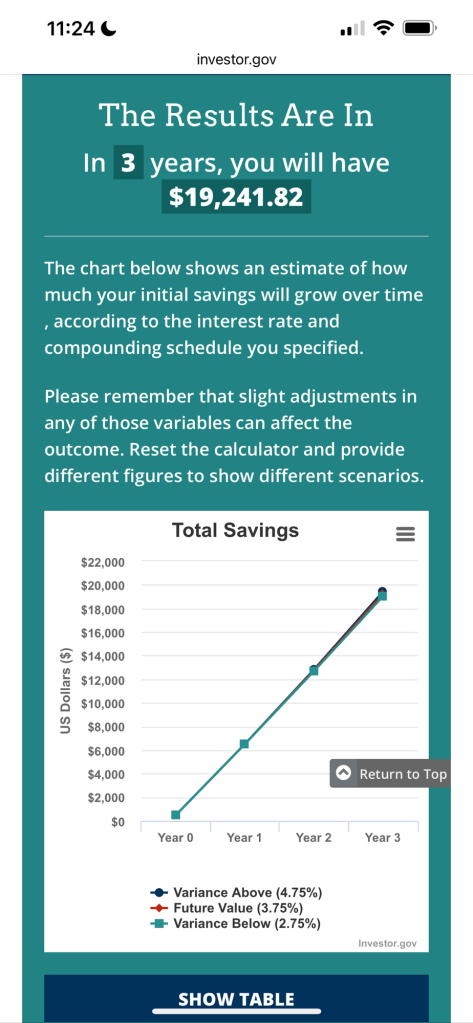

You can follow this example of $500 per month in an HYSA for three years to cover the down payment of a home under $600,000 on an FHA loan. To estimate how much you need to save and for how long every month and how many years, investor.gov has a compounding interest calculator estimation tool and here’s a snapshot of it calculating $500 per month for three years with an HYSA averaging 3.75% APY with a variance of 1% since their rates fluctuate up and down a percentage point often depending on the economy. $20k can easily be raised over three years at this pace as you can see but it’s also important to note, the savings for closing costs have not been included. It would likely take at least four years to fully afford cash to close on a home up to $600k on an FHA loan.

On part 2 of this blog series I will share a few of my favorite savings plans I love to send to clients but for this post I want future buyers to remember you can keep it simple with a flat amount per check or month; but you can also do a simple percentage of your income. Sometimes people just prefer to follow the 10% rule of putting away ten percent on each pay day into an account to accumulate that way. For some, that might actually be a step above a flat amount of $500 percent month or check because many people like to really push their comfort zone as they get closer to wanting to realize their homeownership dreams. Do what works for you. On the next blog, I have some plans to help get you started or you can email me at agentofparadise@gmail.com to customize a better one that’s tailored to you.

What matters as much as your savings plan is your account where these funds will sit. At the very least, your money should be sitting in an HYSA or CD. I have mentioned on many articles before this one how genius using a Roth IRA can be as a savings account hack. Remember that your contributions, all the money you put in through deposits, are not entitled to the rules of fees or withdrawal restrictions so you can always pull them back out without fees or taxes and no requirements to season it like a traditional IRA requires. The interest you have earned (the gains) on your money ARE subject to withdrawal rules so that money must stay until the account is five years old and you’re at least 59 1/2, but otherwise, you can pull out money. Your down payment funds in this way help you build a retirement fund at the same time because those gains can be dispersed when you’re older, tax free! It’s a great hack every eligible person should do—which is most people. You can open an account through Fidelity, SoFi, Charles Schwab, MorganStanley, Edward Jones, etc to get an account open and they’ll guide you on your journey as well so your money grows even better than a high yield savings account or certificate of deposit can.