Every client is different obviously so I am going to share multiple plans and ideas for various timelines and budgets. If you are not sure yet when you will buy a home but you are interested in getting started to plan ahead, choose a savings schedule you feel comfortable with at your own pace, based on your future desires and ability to contribute regularly. For those looking to buy sooner, you likely need a more rigorous plan of attack so it’s more important to choose the right strategy and savings scenario to reach those goals quicker.

For most buyers, the regular contributions should push you to be cognizant of your spending with every dollar coming in and going out; however, it shouldn’t stress you out to save money or prepare to become a homeowner. If the path to savings, even small amounts, is not an easy one to adapt to, send me a message to go over your finances together. We’ll discuss specifics how your goals may be achieved within your unique circumstances.

Plan 1: Biweekly Deposits (every two weeks) I have most clients begin with a $200 biweekly deposit into an HYSA or Roth IRA fund over a 4-5 year period for most buyers to do the average prices in my area which can range up to $650k now for a basic 3-4 bedroom home; but not every buyer needs that many years or that much home to purchase. Currently in the markets I focus on, prices have dipped below the $500k range in my SoCal areas and so 4 years is usually enough to help them get enough for their cash to close and I also help with getting them some seller contributions to make sure they have money to close.

All of my plans are a recommended minimum but I also encourage people to put more in on the weeks they can. If they can’t quite meet these criteria, I work with them to help make it happen and analyze the numbers together. Everyone is in a different situation so we make tweaks and adjustments where needed.

As my clients work through these plans and some are able to work towards more money put away, I help them come with revised plans and calculate their end game goals to meet their ownership aspirations, maybe sooner. Flexibility is key to life!

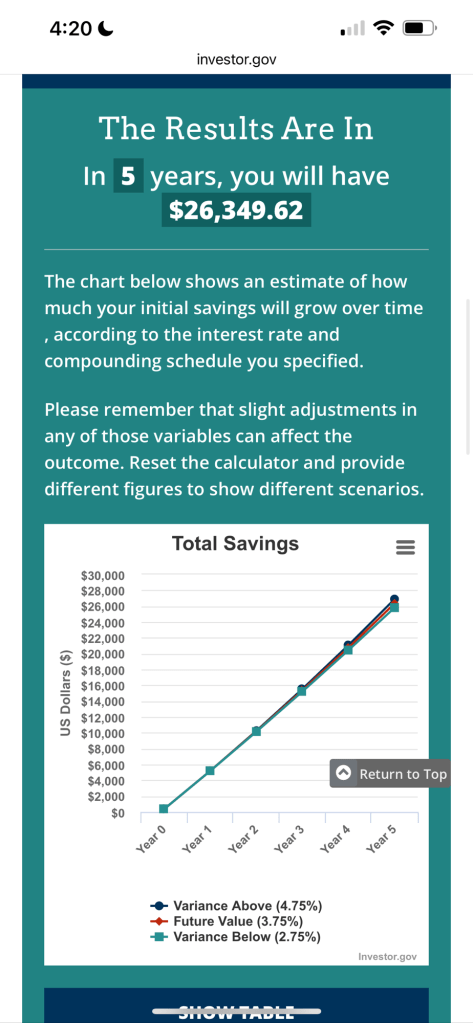

IT’S IMPORTANT TO NOTE: At this rate of plan 1 in a standard bank account such as Bank of America, Chase, or Wells Fargo, this is $400 per month and $4800 per year. Since those accounts barely pay pennies in interest, this would take up to five years to afford a $500,000 home with an FHA or low down payment conventional loan. You’ll have $24,000 in savings. In an HYSA at current rates, you’ll have over $26,000.

If you expect to purchase a home under $500,000 in the next five years, then this plan will help you get there. If you’re looking more like 3 years, you need to put in at least $600 month in an HYSA to get there. It’s so important to know how much of a home you expect to purchase and reverse engineer those steps. That means taking the total you need and divide by the number of years or months in which you wish to purchase. Your monthly deposit will need to hit that number at a minimum to keep on track. This is why I also remind to clients to put some of their tax returns into these savings accounts instead of spending it all on nonessential purchases. Most buyers could purchase a home just on three years of returns alone, especially if they have multiple children. An HYSA will tack on interest to those and at a faster rate because of the amounts of those larger deposits.

Plan 2: Basing your savings strategy on NOT knowing the price range you will buy or how long it will take to get you there is another way to plan when you know where you want to go but not when or exactly how yet. Usually, this is for future buyers who can’t afford $400 right now or are not ready to yet. This could be due to the client being unsure if homeownership is their goal in the near future or are on a much lower budget and are more on a plan of just consistently saving without a timeline or known endgame. You can always reevaluate later and see where pre-approval might land you and what you really want to buy down the road—maybe a new build or lot to build, possibly an investment property one day, etc. For buyers in this situation, might recommended deposits vary quite a bit based on circumstances, income, credit, etc but I’d say for many, at least begin with $250 monthly/ $125 biweekly payments to your HYSA/Roth. This can also be for those with decent income but no clear future plans yet and so for those future buyers, I strongly urge the Roth IRA strategy for savings and $250 weekly because they are more likely to be saving for much further down the road and they have more capital to out away. This makes the Roth IRA hack way more lucrative and sensible because they’ll be gaining so much earned income on their deposits to make their down payment goals easier, faster, bigger; OR, give them an amazing retirement from the gains alone.

Plan Two is for any budget that has hopes for their future but not a laid out vision board yet. If you are feeling from achieving the reality of owning, the Roth IRA is a solid choice even for low income individuals because you also make money for retirement without saving any more money, tax free. Remember that a traditional IRA will tax any withdrawal so that’s why a Roth makes sense and it’s the same for retirement even if you become a millionaire. *It is important to double check with your account holder (the company you opened it with or company HR if it’s an employee plan) to verify the type of account you have, your total contributions but not gains, and the rules for the account you have and if it can be used in this way.

Plan Three works the same way for the same possible buyers who aren’t looking for significant growth in the next three years but could possibly buy in 5 years. The catch is for this plan, you are not going to use any gains or earned interest on your money because that’s all going to defer for retirement but you’ll still have enough saved for a home and closing costs anyway through your own contributions. This is the Roth IRA Savings Plan (self proclaimed by me), or so I call it. This is the maximum contribution plan of $7,000 annually that a Roth IRA allows. Your money will definitely grow but because it’s money earned, gains, the rules of this account stipulate you can’t withdraw until the account is five years old and you reach the age of 59 1/2. I have lots of articles how to grow your money 6-12% year over year using this account properly. The second best option are CDs and HYSAs.

For any type of savings plan, run the numbers for each scenario and be sure to understand the rules, what contributions are and how much you have, and how you want to grow your fund’s portfolio. The most important thing is to have at least an HYSA and a regular plan with consistent deposits, not withdrawals. If you want a link 🔗 to open a SoFi account with a referral bonus, click below. If you’re going to link your payday direct deposit with an HYSA, then this is one of my favorite banks to use. Otherwise, I also use Marcus by Goldman Sachs and Capital One. I love the apps and quick turnaround with SoFi and Capital One! They also partner together and moving money is so fast and easy. They’re my favorites to use daily.