Debt to Income (DTI) is a measure of income and ratio that tells lenders how and what loan product you qualify for. Both FHA and Conventional mortgages have their own DTI requirements; and both use a front-end and back-end calculator for loans.

The front end ratio is your projected mortgage payment to your gross monthly income (GMI). For example:

If you’re pre-approved for a mortgage payment of $3500, that number is divided by your GMI. If you make a gross of $9000, 3500/9000 is your calculation. In this case, it’s 0.38888888 which estimates to 39% (multiply the decimal number by 100 if you don’t know how to calculate percentages) rounded up. This is your front end DTI calculation, here as 39%. This is too high for both loan types. Your income and payments ratio cannot exceed 28% for conventional and 36% for FHA.

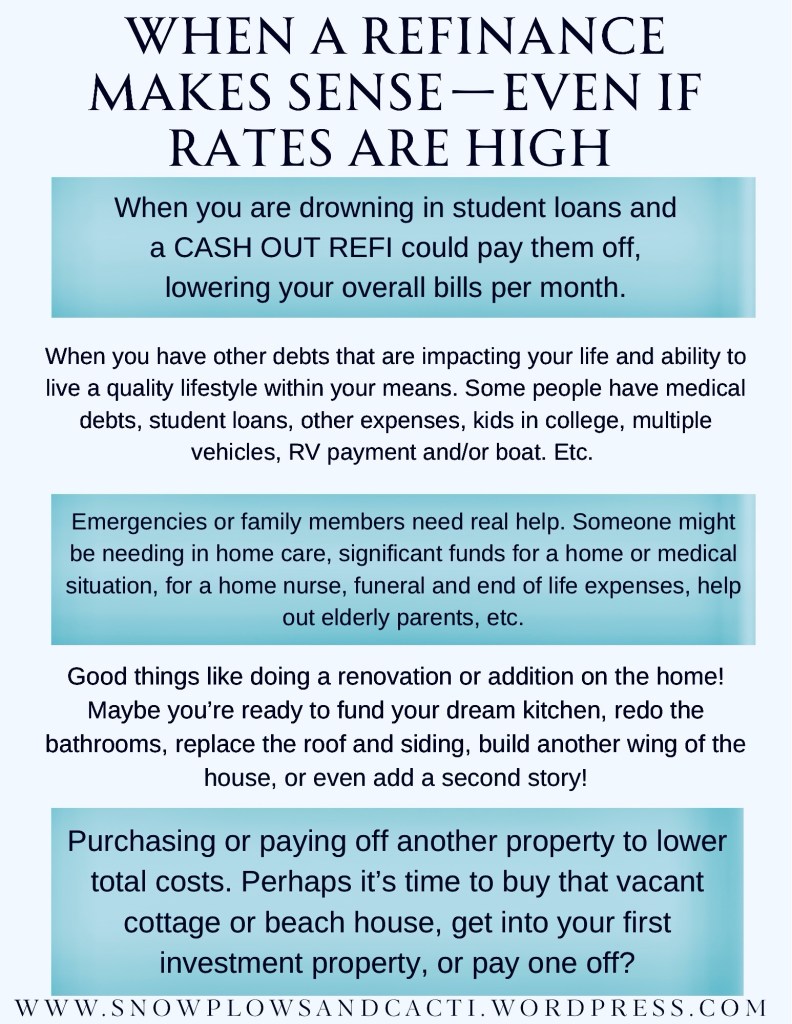

To pass this ratio hurdle, you need to lower your mortgage payment: more down, improved credit, finding a higher income co-signer, a cheaper home, lower tax area, no HOA, etc.

Once you pass the front end DTI requirements, the back end then incorporates all of your current and recurring payments including: student loans, car payments, credit cards, payment plans, alimony, additional payments. All of those are added together with the payment you are approved for. That new number is then divided by your monthly income. That number cannot exceed 43% and 38% for conventional loans.

How to do this on your own before applying:

Take your monthly income and multiply it by .31 for FHA and .28 for conventional. That’s your approximate front end DTI. For your back end, multiply by .43 for FHA and .36 for conventional.

Now, add up all of your substantive expenses, as mentioned above, and subtract them from the calculation you get after multiplying. That’s your back end DTI and essentially your monthly payments you might be paying.

For example:

Take the GMI (we will use $9k as the combined GMI for this sample) 9000 times .43 = $3870. Now subtract your bills. For this sample, we’ll use the scenario below:

You have credit cards totaling about $500 a month in payments, student loans of $600, and two car payments totaling $1,000. Those are expenses of $2,100. Take away from the $3870. You are left with $1770 for a monthly payment. With today’s rates, you’d need a substantial down payment and affordable home price to achieve this. This is for FHA. For conventional, you would be approved for even less. This is why car payments and credit cards are so horrendously damaging to your home buying chances; and this is with excellent credit.

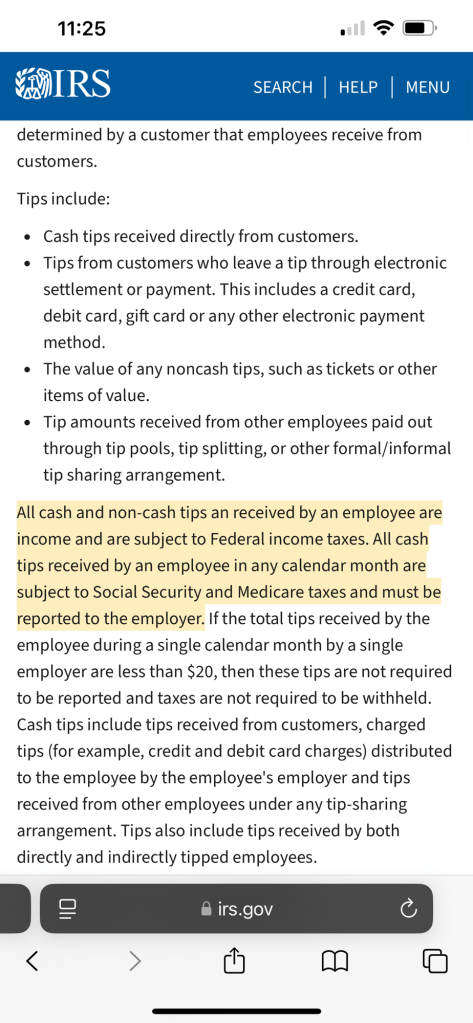

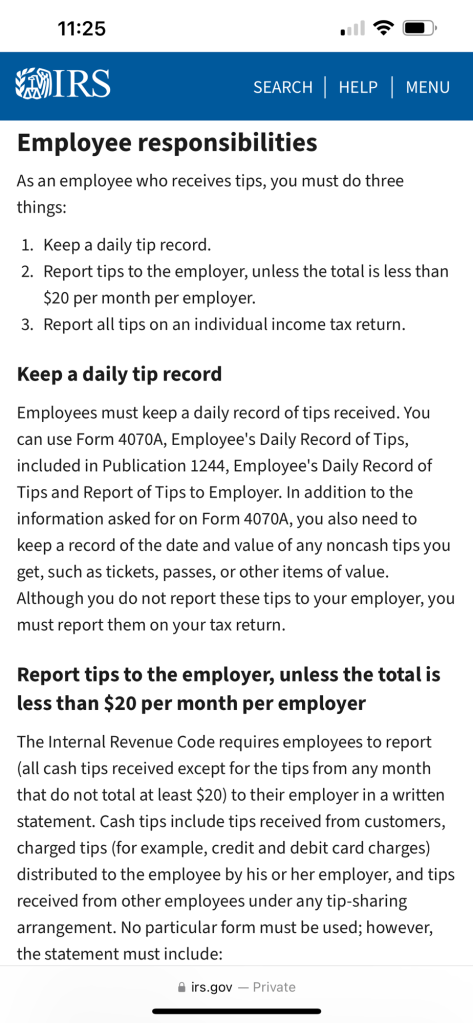

If you don’t have student loans and two car payments, you’re doing great! If you also paid down credit cards (never cancel them!), you’re doing even better. Keep in mind, we do NOT incorporate payments like child care, cellphones, subscriptions, and of course utilities and food. So you have a lot of monthly expenses you need to take into account on your own. Knowing your finances is the most crucial part of applying for a loan and determining what you can afford. Remember too, payments often go up after the first year when insurance and taxes often reassess. This can increase a few hundred dollars in some areas so have wiggle room, always. Don’t buy what will push your wallet.

There are a lot of mortgage calculator websites online and you can Google one as well. They’re all a bit different but will give you a ballpark range of what you might expect to pay. If those numbers aren’t affordable to you, that’s probably accurate enough but check with a lender to be sure. You need to know all of your bills, not just what lenders look at, but EVERYTHING, and think about other lifestyle factors and having money to live life too. What you can afford and what the ratios say will determine your approval amount. Knowing how ratios work though, will help you work through your finances and help you on your path to buying.

If you need more help calculating your income and payments, email agentofparadise@gmail.com and we can review your options together.