The first thing you should do is go to www.annualcreditreport.com and pull your report to make sure there are no open accounts you don’t recognize and make sure any older accounts (besides bankruptcies and evictions) are off. Most should be removed after 7 years. Most medical debt is not your big focus but old credit cards you defaulted on, loans etc, and foreclosures that are 7-10 (depending if they’re part of a bankruptcy filing) should also be gone too if they’re over 7 years. You report needs to be cleared to really start building credit or you’re going to need to look at your newest debts and start paying them down. If you’re deep in debt, those need to be cleared before you take action and begin building a new credit future. If you had something repossessed and still owe on that balance, especially if they’re a newer debt (5 years or less) they’re going to be keeping your future from happening. Own up to the past and take care of it. We all make mistakes, hit rock buttom, and we all have to dig out of a huge hole. Just do it and pay your obligations. You incurred the debt so just make it right not for the company but for YOU. Your future deserves a fresh start but it can’t happen if you don’t remove all the junk you want to leave behind.

You need a clean slate, or at least have no negative hits anymore that are on there, and start from scratch. From personal experience and many others I have seen start over, Capital One and Discover are the best and easiest cards to get with no credit. You need a stable income of minimum wage, full time usually, and be able to pay your current bills and the card but you can include household income even if you have roommates, live at home, or have a spouse who helps cover a lot. If you get approved, it’s usually around $300 or so but that’s all you need to start! If you don’t get approved then refer back to your credit report and look at what is still outstanding. What’s there could be holding you back. If you don’t have much or anything on there, consider your bills could be the problem and maybe other debts. If you have student loans that could be the problem, consider paying an additional $100 a month and calling to renegotiate your interest rate. Explain you’re going through financial hardship and want to know if there’s any way you can save on your payments without incurring more long term debt or hurting your credit. Those two things should help a lot. I’d also try again in 30 days or so to those credit cards and see what happens. Make sure your credit also isn’t locked at the three credit bureause like LifeLock or something like that.

Try the Discover It or what I did was the Capital One QuicksilverOne. You can get a sign up bonus here if approved: https://i.capitalone.com/JeXD0GYGb for free once you begin charging.

Another option that does work but is slow going are secured, or bank prepaid, bank credit cards. They have to be regulalry used and properly paid to have any impact and in the first year you may not not notice much because credit building is a long term commitment with them and it’s harder to get built up. Secured cards also don’t work as quickly for many people, especially if you don’t keep up using them and refilling, so keep that in mind. At the start of every calendar year, also pull your free annual report again and see what’s reporting, removing, showing no longer, and what’s looking better in terms of debt amounts. This report doesn’t show a score but amounts and companies with your identity attached to them so make sure nothing is there that shouldn’t be!!

If you need more help starting over and building from nothing email us at jenniferlarsonent@yahoo.com and ask for the Road Map. It’s a free resource we have to help you get started. In the subject line be sure to write “Free Road Map” to be sure it doesn’t get lost and we’ll send it to you!

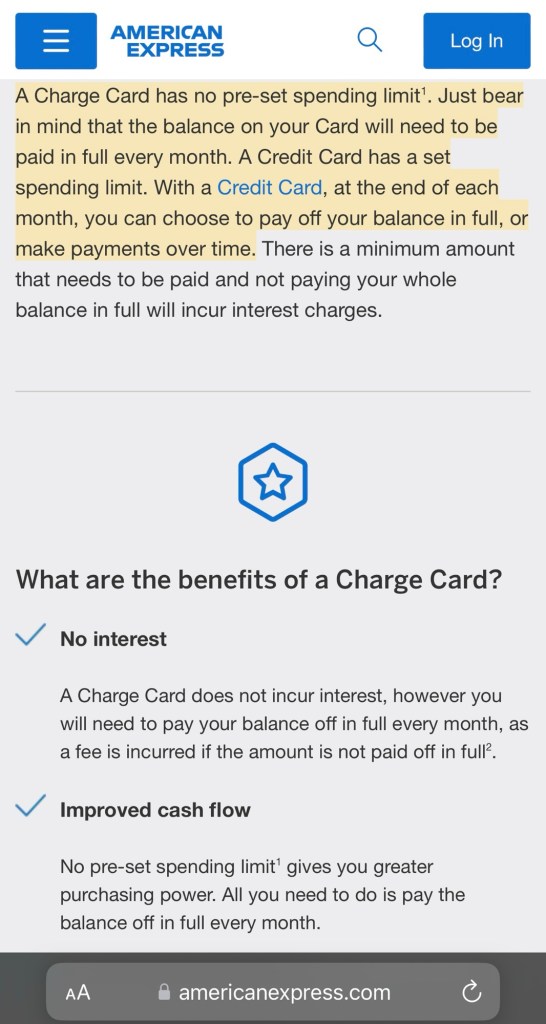

Once you get some type of card from a reputable company that will help you grow your score over time, keep up with it. For a secured card, your deposit is your prepaid limit so keep doing it every month or put your paycheck on it each check and build that way. For a standard credit card, multiply your credit limit by .1 and that is 10% utilization rate. To build your credit faster, never leave more than that number as a balance every month! If you charge more pay down to that amount every day so it doesn’t ever exceed. Having $200 on your bill out of a $300 limit is a 2/3 utilization rate (not good) and also means lots of interest so pay it down. Use it like a debit card, whatever you charge, pay most of it off every day so less than 10% of your limit is on your card at any given time so whenever your credit report updates it will only show your good payment history and low risk of maxing the balance. That’s how you build credit fast!

If you have a solid history after six months of use (or another card giving you decent credit) you can apply for the SavorOne card https://i.capitalone.com/Jruy7M3nV and get a sign up bonus here if approved. This card is being called the unknown hero in the game and one of the best credit cards on the market without an annual fee because it gives you 3% cash back on groceries in store and 1% on other purchases but after another six months you can keep that saved cash back to apply for the Capital One Venture if your credit is close to 750 with decent income and you can convert that rewards cash to miles for free travel! That’s what I’m doing and banking my travel rewards to earn a free flight to Europe with my kids. All of my daily expenses go on the card and I pay at the end of the day and don’t spend my rewards cash until I transfer them. There’s a secret to this so follow the Points Guy, Upgraded Points, and others how to do this to 10x your miles for free!!

After a year you can upgrade to a third card if your credit is building well enough and then just keep your payment history excellent, your utlization statement balance low, and keep going. Longevity of these factors will raise your score even more so you can start seeing 800s and get qualified for better home and auto loans, refinancing debts, and more. Going from 750-800 is very much like losing the last ten pounds and this is really where the long game comes in but it’s important to keep going and understand, it’s easy though timely. As long as you’re paying your bills on time and not carrying big balances, or closing accounts, you’ll see big returns! I have seen a 775 credit score not be enough for the best rates in mortgages many times so I strongly encourage future homeowners or those wanting to refinance to hit the 800 mark and keep over it because that will save you thousands and give you by far the best options. Keep it up!! You’ve got this.