The news makes the real estate market sound like a somber time but for buyers, this is THE time to buy a house. Why? Because when the market is this bad (one of the worst months in the last 30 years!) it means sellers are only selling because of a need right now. They might be relocating for work, financial reasons, divorce, other needs, and are having to sell in a difficult market knowing their home is going to sit for sale on average 3-4 months. It might even be creating a financail burden, as well as an additional stressor, so typically this creates a buyer’s market because these sellers need to sell soon. This means the market is ripe for buyers to have the upper hand and have all the leverage. Most sellers aren’t getting a lot of showings and open house guests nor offers so they’re stuck taking what they can get. Beggars can’t be choosers so if you’re interested in their home and you are the only offer they have received in weeks, you have the leverage to get yours accepted if it’s even remotely near their asking price. You also have the leverage to ask for seller credits to cover closing costs, or— rate buy downs. This is far more powerful than asking for $20k under list. A credit of the same amount, paid by the seller, nets them exactly the same BUT, it lowers your mortage payment far more than getting a discount on the total price.

Always remember: Your RATE is what makes your payment more expensive, not the sale price.

Allow me to demonstrate. Let’s say you purchase this house in Cathedral City, CA for twenty-five thousand under list price. Before taxes you and your spouse each gross about $4k every month or $48k per year before taxes. Your credit score averages to 715 and no other debts such as student loans, credit cards, or car payments. You have no HOA.

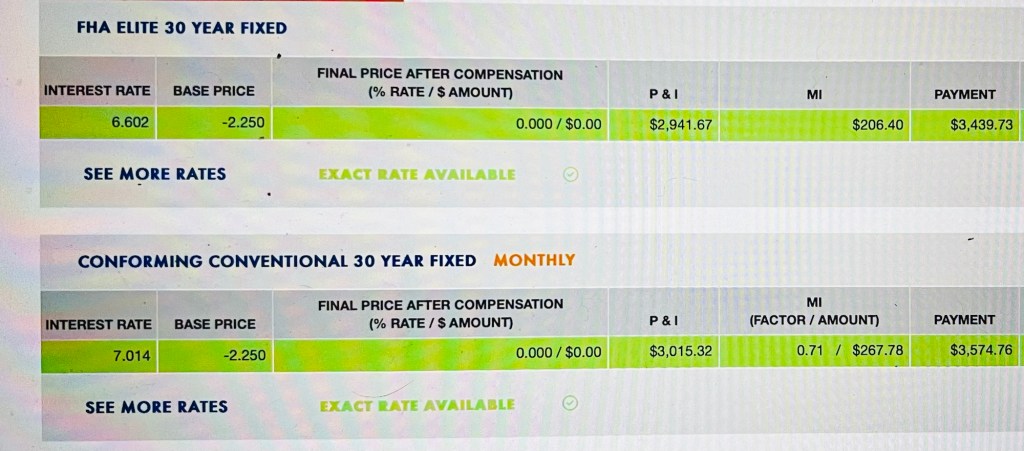

Your payment could look something like this with rates as of 10/8/2024:

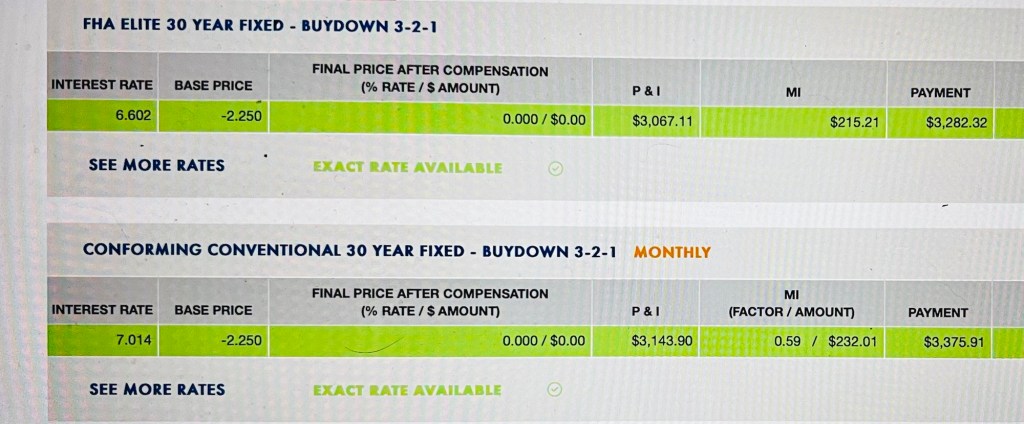

If you instead asked for the seller a credit to cover your rate buy down and get an approximate rate reduction based on a 3-2-1 buy down, here’s what you could pay every month while still paying list price and giving the seller essentially the same offer:

See the difference? A good agent knows this and won’t suggest a price drop but instead a real way for you to save on your monthly payment. You do NOT need to wait for rates to drop to get a better APR, you just need the right agent and lender to get you there.

If you need a real estate agent who can help you negotiate the best deal and find you a home in your payment range anywhere in the country, email agentofparadise@gmail.com and I’ll send a you a referral depending on the area you need for buying and/or selling. If you need a lender in California, I can help with that too! Send me an email and we can set up a time to talk or get your application started. I look forward to helping you any way I can.