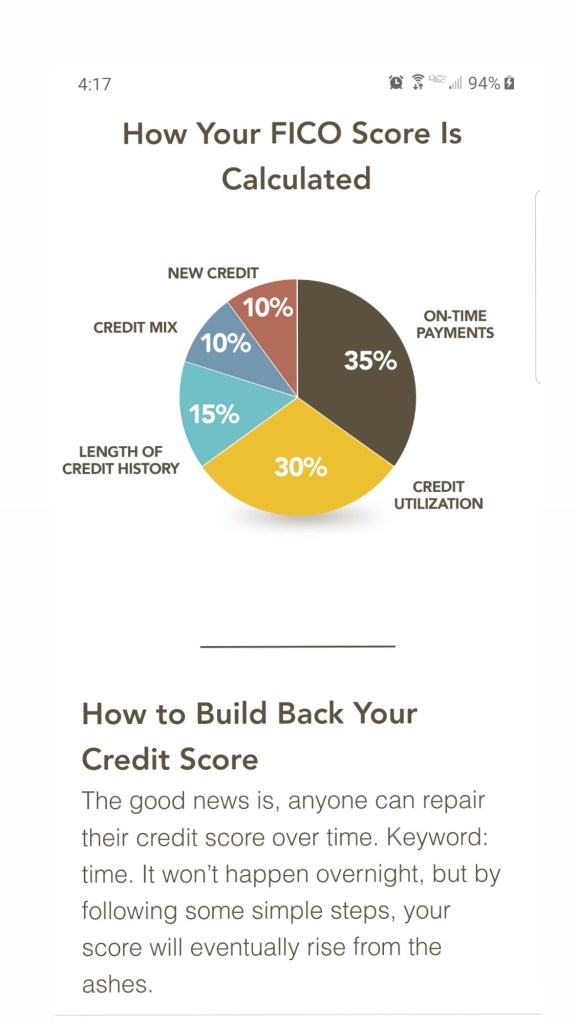

Over the years I have talked about not liking credit cards for many reasons because of how it can send clients into a spiral of bad spending and lowering their DTI score for their loan. The problem is, some people have no credit and need to build it. What then?

Unfortunately it is true that building credit is most easily and quickly accessible through opening a card. I eventually did this when secured cards weren’t readily doing much for me. I opened a Capital One card and was approved initially at $300 which is actually GREAT. You want just enough to build credit but not any more to get you into trouble and debt. The Quicksilver ONE card is geared for people who have no bad credit but not good credit either. It starts you on a small credit limit and gives you at least six months to prove your creditworthiness of ontime payments and responsible spending before you’re eligible for a credit increaase or new cards.

If you have low to no debts and a decent income of even $25,000 you might get approved. If you have a higher household income that’s even better. Again, other debts always impact your approval chances which is why it’s so important to not have any or low in relation to your income. If you approve just on your income with no rent or car payments, student loans, etc you will have a great chance. I did this and built my credit quickly in a few months by never being late and always paying before the due date. Of course, you can use combined household income too which helps.

If you want to get one too, email me for an account credit. Their pre-approval tool makes it easy to see what cards you’re eligible for with no impact on your credit score. Plus, no credit score is required to apply. The app is so easy to use, make payments, track your credit score free, and monitor your accounts instantly. This is not an ad but I do love my card and the customer service.

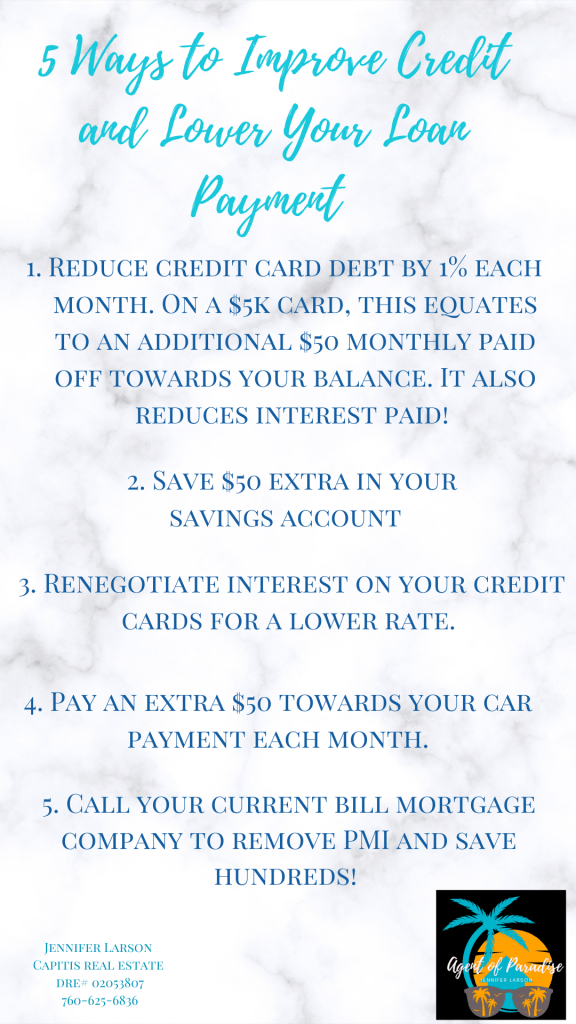

There is no magic trick to building a credit profile and growing your score. It just takes a few months, paying your statements on time, not overcharging, and slowly applying for a second card, and having an excellent payment history there too. Don’t close accounts either but rather pay them down and keep them open, even if they’re unused. They still produce a score and show lenders you do have established credit history even if it’s not in use–which is good!